India is embarking on one of the world’s largest and most sustained procurement cycles. India has introduced Defense Offsets and due to it being one of the top military spenders in the world, the offset obligation is a significant opportunity that will need to be addressed by the expansion of private defense manufacturing.

India is embarking on one of the world’s largest and most sustained procurement cycles. India has introduced Defense Offsets and due to it being one of the top military spenders in the world, the offset obligation is a significant opportunity that will need to be addressed by the expansion of private defense manufacturing.

As India is moving to transform itself from a regional power to a global power, the aerospace and defence sector is increasingly becoming critical in the country’s long term strategic planning. India has evolved as the most lucrative aerospace & defence market globally.

The Defense sector has huge potential in India with the country ranked as the 10th largest investor in Defense globally. The industry is currently undergoing a transition with increased participation from the private sector. Private sector participation has been growing immensely in India’s indigenous Defense production as the sector transitions from being a supplier of raw materials and parts to one undertaking full scale licensed production.

The ambition to develop an indigenous Indian defence industry has been given increased prominence in the recent past and highlighted in policy statements both from government and opposition parties. It has been emphasized that both the Indian public and private sectors should play a larger role in producing state-of-the-art equipment for the Indian forces.

The challenge in India is to build domestic capability, which would be fully based on cutting edge technology. The process requires Indian public and private sector defence companies to leapfrog technologies and start designing, developing and producing state-of-the-art systems in the immediate future and not through protracted development programs. The only way to do so in a rapid way is to make use of technology developed by companies outside India.

Currently, defence procurement has tried to tackle this challenge mainly through strong offset requirements. However, while offsets do meet the requirement of a return on expenditure for a country, it has not proven to be adequate for developing an industrial base in the purchasing country. It rarely accomplishes a true transfer of technology to the Indian company. Foreign companies often leave once offset requirements are met.

The end result of the Government’s efforts should be the creation of a foundation for an indigenous defence industry that will ensure that the country does not need to look externally for its future strategic defence requirements. In addition, such programs should have significant spillover of technology to non-defence sectors.

The Make-in-India initiative of the government is focussed on 25 sectors that include defence manufacturing. Is it a renewed invitation to foreign companies for, or a call to the Indian industry to shoulder greater responsibility in, making India a defence manufacturing hub? It could well be both but there is little doubt that the main focus of the initiative is on the foreign companies.

Make in India – a reality check

The new government’s ‘Make In India’ policy and increase in the Foreign Direct Investment (FDI) cap in the revised defence FDI policy (from 26% to 49%), announced with a lot of fanfare during the Aero India show in February this year, was seen as a major step to revitalise the defence industry and awaken it from its long slumber. This government action was expected to infuse refreshingly new attitudinal change in India’s policy-making processes, foster a trust between the government and the industry, and usher in major reforms to improve India’s standing in World Bank rankings.

Accordingly, a number of committees under retired bureaucrats were set up by the government to review the problems being faced, and recommend suitable solutions to improve the business environment in India. However, despite the prime minister’s personal thrust toward the ‘Make in India’ mantra, very little has changed on the ground. This is evident from the fact that even though the government has increased the FDI in the defence sector to 49%, there are almost no takers so far. According to the latest figures tabled in the Parliament in March 2015, in the last seven months, only six proposals worth USD15.3 million have been received. Out of these six proposals, only two are for FDI of 49%. So, why are things not working out? Let’s find out…

Despite various committees being appointed, no marked changes are visible on the ground — be it the negative fiscal environment (including taxation), the lack of critical infrastructure (roads, ports and power), antiquated labour laws, or corruption continuing to loom large. Manufacturing requires a significant edifice of infrastructural support, which is currently absent in India. There is a lack of regulatory framework, especially in the general aviation sector, which has a huge growth potential. Reforms require ongoing consultations with the industry, and presently, there is no positive movement on this.

IESA President M N Vidyashankar comments on Indian A&D industry as, “Indian Aerospace and Defence verticals are one of the most promising sectors with a booming market & an ocean of opportunities for Companies to take the manufacturing plunge.

The allocation for Defence in the last budget was approximately USD 37.3 Billion. The country has the 3rd largest armed forces in the world. India is one of the largest importers of conventional Defence equipment and spends about 40% of its total Defence budget on capital acquisitions. India’s current requirements on Defence are catered largely (around 60%)by imports. There is a huge opportunity to avail Defence offset obligations, to the tune of approximately INR 250 Billion during the next 7-8 years. The country’s extensive modernization plans, increased focus on homeland security and India’s growing attractiveness as a Defence sourcing hub open up vistas of opportunities.”

Talking on ‘Make in India’, he says, “The government policy of promoting self-reliance, indigenization, technology upgradation and achieving economies of scale and developing capabilities for exports in the Defence sector is definitely a great step forward for the Make in India initiative. Components & sub-systems will, initially, get a big boost and will enrich the ecosystem. In the medium and long term we can see large integrators playing an active role.

To help the industry Government has taken various steps in the last one year. A list of Defence items requiring industrial license was notified in June 2014, a security manual for licensed Defence industries was also notified in August 2015. The FDI cap for the Defence sector was increased to 49% with a provision that even higher FDI could be permitted if it provided access to state-of-the-art technology.

Still there are various challenges which need to be overcome to help the sector grow. One of the common factors pertaining to all sectors and a part of this sector as well is the ease of doing business, ensuring long term relationship between the buyer and the suppliers – since this is a monopsony market, security of investment and intellectual property rights, and returns on investment.

Funding remains a key challenge for any start-up in this sector that plans to raise fund.”

Saison support on Components Obsolescence in A&D Industries

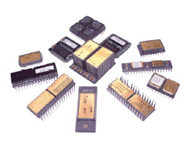

Electronic Components obsolescence is a major problem for military and aerospace manufacturers. It is estimated that 60 percent of integrated circuits currently on aerospace products will be obsolete (out of production) within five years because production cycles of today’s components are far too short to support aerospace products whose useful lives exceed 30 years.

Components obsolescence has always been an issue for buyer in the defense and aerospace equipment Industries. Equipment built by manufacturer tends to have long life cycles that outlast the life spans of the semiconductors and other components that are critical to those systems. It is forcing OEMs to change their design of equipment, which is now a big issue in Indian defense industries. To change any single parts in running products involve lots of R&D cost and time.

Now Saison Components & Solutions is managing this type of issue with the support of Force Technologies, we provide a continued manufacturing source for discontinued or obsolete semiconductors, such as Memories, Microprocessors, Linear, Logic, Opto and Discrete devices in order to support many legacy products in all industries. We have ability to provide long term support of obsolete items and our commitment to excellent levels of customer satisfaction which is independently audited by a third party.

Force technologies established world class reputation for supplying high reliability components to the Aerospace & Defense industries. Force skill set can be directly applied to pro-active management and resolution of EEE component sourcing, which is a major problem for defense and Aerospace Industries.

We offer sustainable solutions for obsolescence management.

- Recreation on obsolete components.

- Rework or modifying components to meet original

Specification of parts.

- Die Reclamation.

- Maintaining stock of products for long term.

We also offer FPGAs, FPGA to structured ASIC, hybrid or standard cell conversions and ASICs. By using a library of intellectual property (IP) cores, or by re-introducing otherwise dis-continued masks, we have managed to reproduce devices that are form, fit and function (FFF) identical to the original OEM or close enough to be acceptable to the project. These devices are manufactured using Mil-prf-38535 and tested to various specifications including Mil-Std-883 M5004. We have even undertaken project management of semiconductor from design to production when all other options have been discounted.

Other than above mentioned products Saison can also offer complete component solution under one roof like EMI Gasket, Cavity Filter, SawDevice, Adapter, RF Connectors, Modules to Defense and Aerospace industry.

Website: www.saisoncomponents.com