Technological developments in engine management and the incorporation of safety systems in cars will be the key growth drivers for the Indian automotive electronics market in the next few years as it attains a compound annual growth rate (CAGR) of 21.8 per cent, as per research report.

Technological developments in engine management and the incorporation of safety systems in cars will be the key growth drivers for the Indian automotive electronics market in the next few years as it attains a compound annual growth rate (CAGR) of 21.8 per cent, as per research report.

India – the Lucrative Market

Automotive industry is the key driver of any growing economy. It plays a pivotal role in country’s rapid economic and industrial development. Indian automotive industry contributes significantly to the overall GDP of the nation and also provides significant business and employment opportunities. It is an engine of growth for the Indian economy. It is one of the key industries whose well being is very important in our vision of improving the living standard of our population.

The automotive electronics industry consists of four major sectors, wire and cable harness, automotive electronics, engine and powertrain and safety and warning systems. The industries most representative products are airbag igniters, engine control units, tire pressure monitor systems, vehicle stability control systems and adaptive cruise control units.

The Indian automotive industry is witnessing a phase of rapid transformation and growth, mainly driven by stable economic growth and infrastructure development. The Indian automobile industry has emerged as the seventh largest in the world, and the auto components industry is gearing up to compliment the vehicle industry’s growth.

Global auto companies are closely watching the Indian market, to exploit the future demand potential, and to use India as a global sourcing hub.

While market potential and opportunities remain vast, the industry will be posed with important challenges and bottlenecks that need to be mitigated in the most cost effective and efficient manner, to attain common objectives.

In the coming decade, the main focus would be on enhancing efficiency and productivity, and on innovation, both process and product, driven by changing customer demands. Price sensitivity of the Indian consumer, cost optimization needs of manufacturers and increasing focus on environmental concerns will drive critical changes in the market.

Government’s continued reduction of import tariffs coupled with investor-friendly laws are expected to go a long way in enhancing the prospects of the automotive industry. Further, the rising middle class is moving away from motorcycles to entry-level cars, giving vehicle manufacturers opportunities to strategize and innovate.

Smart Automotive Technologies find Opportunities in India

With the advent of Internet of Things (IoT) and approximately 6.5billon connected devices predicted by 2016, will see a lot of technology-driven advances. Intelligent machines, mostly driven by Electronic Control Units (ECUs), will drive this innovation. Talking about the auto industry in particular, digital electronics are now the driving force behind 80 per cent of all innovations. Key functions are already controlled by ECUs such as engine management, infotainment/navigation systems, ABS, ESP, Park Assist and so on.

Factors that contribute to opportunities for India are: firstly, Asia seeing a higher growth rate compared to mature markets in Automotive Electronics. There are a lot of reengineering activities taking place in India. Being a significant market, engineers in India have the opportunity to be noticed on a global platform. Their products have the potential to impact global markets.

The second factor is the availability of choice for the Indian consumer. As the cost of ECUs are driven down, the consumer in India can afford more electronic features in their cars at the same price point. Indian engineers have the opportunity to design features to address specific needs of the local market.

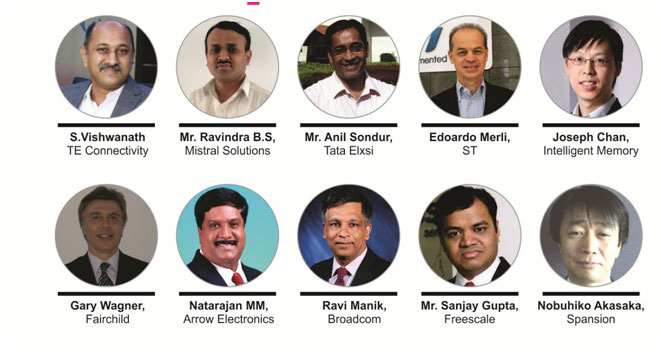

The below are some highlights from key industry veterans on India Automotive electronics market growth and the key drivers influencing the new trends and the technologies in automotive marketplace.

Nobuhiko Akasaka , VP Automotive Business Division, Spansion

While the current market is relatively small, it is growing in the double digits very year through 2020. We especially see demand in the motorcycle segment, which requires many mechanical applications to be converted to electronics (e.g. cluster meter).Assembled parts, called localization, are giving the Indian economy a boost from current import driven components.

The export market for India is also expected to increase with global OEMs exporting in double digits. In addition, global OEMs including Toyota, Nissan (JV with Renault), Honda, VW, GW & Ford are investing heavily in the Indian market by increasing their manufacturing capacity and establishing local R&D to evaluate the market requirements. OEMs are trending toward localizing electronics development considering the cost competitiveness of the market. Spansion is closely observing the developments in the market and has plans to grow its local customer base. We see Safety, Security, Energy efficiency and human machine interface (HMI) are the main drivers.

Spansion Focus

We focus on Electrical cluster meter for all segments of 2 wheeler and 4 wheeler, body control modules (BCM) and CDI for mid to high-end 2 wheeler, BCM and HVAC for 4 wheeler.

Technologies at a Glance

Human machine interfaces (HMI), including 3D/2D graphics and input method (e.g. voice recognition) and connectivity is growing in demand to improve the user experience and driver safety with new applications coming inside the cabin.

The role of standards

We implement the features defined by the standards organizations in our products. However, sometimes there are several different ways to achieve such features. Therefore we don’t just follow the specific standards but are always watching the real market requirements and designing our products with customer requirements in mind.

In terms of quality, automotive standards requires strict quality, we follow very tough quality standards to meet our customer demands from design to production. Our production targets zero PPM.

Spansion Support

We are visiting customers frequently including Global & Local OEMs, participating in exhibitions and road shows. Spansion always supports not only local market requirements but also global R&D and production since our customers have locations around the world and look to us for global support.

Gary Wagner, Director of Automotive Marketing, Fairchild Semiconductor

There are several market drivers in the automotive sector, including economic, ecological, and safety. The automotive market is impacted economic factors including global GDP, consumer confidence, employment levels, availability of credit and fuel prices. Typically, economic factors that impact disposable income also drive the automotive sector. In addition to economic drivers, the automotive sector is impacted by ecological and safety factors and concerns that are quite often mandated by governments, including fuel economy and CO2 emission levels. Advances in electronics have enabled automotive manufacturers to increase the value in their products by offering more features and improved reliability.

New technologies evolving in this sector include semiconductor electronics capable of delivering more efficient power management and conversion systems. These products are important drivers of improved fuel economy and emissions performance.

Fairchild Focus

Our focus is to provide innovative, high performance semiconductor products that enable the automotive manufacturers to produce exciting new vehicles delivering the best fuel economy and emissions performance possible. Fairchild works closely with customers to ensure that our products deliver the right features and performance as well as the best reliability.

The role of standards

Standards organizations are important to focus the resources of both suppliers and the OEM automotive companies, allowing priorities to be established and providing direction for investments. Standards organizations have and continue to play a significant role in the development of safer, more fuel efficient vehicles. Standards organizations can also help to challenge the cost assumptions and drive best practices across the sector.

Obstacles in the path

One of the biggest challenges to achieving the automotive sector’s full potential is managing the cost of implementing innovative new technology. As noted above, there are economic drivers to consider that will impact adoption rates of the new technologies. Investment in new technologies can be delayed if adoption is delayed due to economic factors.

Fairchild Support

Our activity has been focused on developing and providing products that are focused on the fuel economy and emissions drivers – enabling implementation of HEV/EV systems, electrification of vehicle loads, and improving the efficiency of traditional powertrain systems.

Edoardo Merli, ST Marketing and Application Director, Automotive Product Group for Greater China and South Asia Region

We can see more electronics coming in two wheelers, Passenger & Commercial Vehicles. From the final demand perspective, India’s yearly consumption of semiconductors is around 7 billion USD, from which around 5% is in Automotive. In the local automotive manufacturing, electronics consumption is already close to 10%. With 50 USD per Indian car, the opportunities for increasing the semiconductor content are close to infinite, in all areas i.e. Engine Management System, Passive Safety, Active Safety, Infotainment, Body control, Hybrid Car. Few examples Start/ Stop feature, accurate & stylish instrument clusters, driving lights with more intelligence, introduction of RKE & Immobilizers, Auto Manual Transmission, Airbag introduction in mid segment cars require electronics. The evolution of the society and of the automotive industry in particular has been an increasing pervasion of electronics and semiconductors and India is not immune to this megatrend. Overall the production of vehicles is above 20 Million units and the average semiconductor content in India is steadily increasing, now around 50 USD per car and 5USD per 2 wheeler.

ST Focus

ST is focusing on developing smarter solutions for the car to make it greener, safer and more comfortable. ST is continuously investing on new technology to offer smart products. At solution level we are closely working with our customers to understand their requirements. Leveraging ICs and solutions already developed for other regions and deploying them in India will also contribute to an increase of the functionalities for comparable system costs.

The role of standards

Emission regulations, safety regulations are determining the wide adoption of solutions and the related electronics by car makers. Networking standards, Can or Lin for instance, are of course playing a key role: Control Units in the car are to obey to specifications to be connected to the car network.

In other segments too, such as Infotainment, standards are key and are becoming very important: radio are evolving to digital (India is considering DRM) and several bodies are specifying the features for the new digital standards, connectivity with appliances in the car mirror link, terminal Car play Google OAA) is more and more driven by consortia defining specs for the communication, Bluetooth and Wi-Fi are of course driven by standardization bodies.

The car to X communication is being specifies at IEEE and Iso level (DRSC, 802.11p).

There are also alliances (such as Autosar, Genivi) trying to standardize SW platforms to for Automotive systems: OEMs, System suppliers, silicon suppliers and SW suppliers are all involved in this initiative.

So regulations and standardization are really a key factor driving and defining the direction and the evolution of systems.

Obstacles in the path

The market is also linked to the general economic situation, an overall improvement of the economy and decision of government to introduce incentives can boost the market.

Consumer demand for greener, safer solutions is an important pull in factor as well, the consumer invasion of the cars (i.e. Infotainment) could also make car makers adopt and introduce new features and make system more open and consumer-application oriented.

Infrastructure development is another important factor to enable the automotive market to grow.

These driving factors have to be coupled with affordability: the challenge that system, module makers, silicon and solutions providers (still) have is to provide feature-richer products at a market affordable cost. And this is another direction and parameter driving innovation in our solutions.

Anil Sondur, Vice President, Transportation Business Unit, Tata Elxsi

The Indian automotive industry is witnessing a phase of rapid transformation and growth, mainly driven by stable economic growth and infrastructure development. From being a low-key supplier providing components exclusively to the domestic market, the industry has emerged as one of the key auto centers in Asia and is today seen as a significant player in the global automotive supply chain.

The Indian auto component industry is expected to register a turnover of US$ 66 billion by FY 15-16 with the likelihood to touch US$ 115 billion by FY 20-21 depending on favorable conditions, as per the estimates of Automotive Component Manufacturers Association of India (ACMA). In addition, industry exports are projected to reach US$ 12 billion by FY 15-16 and add up to US$ 30 billion by FY 20-21.

Also the annual market for passenger cars which is currently 2 million is set to become 5 million by 2020. Today car makers are competing to bring in advanced features, connectivity and entertainment, advanced safety and improved fuel efficiency to their products to attract potential buyers. To address this ever increasing list of consumer needs, more and more technological advancements will happen and automotive electronics will play a pivotal role to satisfy all the user requirements. This paves way for complex electronics systems and therefore providing cost competitive electronic solutions is a challenge and an opportunity for Indian automotive companies.

In the Indian market scenario, consumers who drive medium or low cost vehicles are interested to have latest features in their vehicles but they are very price sensitive. Economic growth, government policies, rising interest rates and fuel costs are critical elements which a buyer tends to consider before making a purchase decision. Thus price sensitive customers and suppliers must find innovative and economical ways of producing systems at much lower costs for the Indian market. Most of these are macro-economic in nature and automotive sector has to swim through these

Tata Elxsi Focus

Tata Elxsi is one of the leading Embedded Engineering service providers working with some of the famous vehicle OEM’s and component suppliers from the automotive industry which also includes Indian companies.

The challenge for a design and technology company like ours is to keep pace with the latest trends in the automotive electronics market which will help in developing innovative and cost effective solutions for the future needs.

Tata Elxsi continues to focus on enabling development of innovative products and technologies which includes new platforms and solutions for connected cars, In-car infotainment, Body & Chassis, powertrain systems, next generation UI / UX and enhanced safety for the passengers by developing Advanced Driver Assistance Solutions (ADAS). We are already a technology partner for multiple customers supporting them in developing new products and will continue to do so in a much higher scale.

Technologies at a Glance

Tata Elxsi has been in the forefront for developing and integrating some of these solutions to global automakers. We are involved in making the car look classier by developing futuristic cockpits by adding innovative HMI screens. We are also committed towards making the car become more safer by developing Advanced driver assistance systems (ADAS) like Lane departure warning that alerts the driver if he / she veers away from the lanes, drowsiness detection system to warn if the driver gets drowsy behind the wheel, blind spot monitoring that enables one to see areas around the car that you could never see with standard mirrors and so on.

With increasing fuel costs and pollution levels, the future of the industry depends mainly on alternative fuels and alternate mobility sources like fuel cells, solar powered etc. The challenge for companies will be to come up with newer engines and transmission systems which will be less polluting and at the same time highly fuel efficient and performance oriented.

The role of standards

Today the auto industry is witnessing rapid technical progress and an increase in complexity and therefore the architecture of innovation and standardization is also changing. Most of the firms do not want to face the high costs and risks of a stand-alone standardization strategy. In order to gain advantages through industry-wide standardization, companies are learning to work together in areas which are not relevant to competition. Standardization in basic areas leads to a more efficient competition. This is due to the fact that after standardization of irrelevant basic components the race is focused on developing innovative applications that will be crucial to stand out among competition.

Tata Elxsi is a Premium Member of AUTOSAR Consortium, Member in COMASSO, R-CAR member and an Associate Member in GENIVI Alliance. Our associations with these automotive industry bodies helped us in delivering value added solutions to our customers.

Thus our association with these industry bodies helps us to understand the trends in the Automotive Electronics and how automotive ecosystem is planning to address them.

Obstacles in the path

The challenge is for both the Government and the automotive industry. The density of cars in India is currently 15 for 1,000 people which is one of the lowest in the world compared to 600 for 1,000 in USA. Thus:

- Infrastructure upgrade is the need of the hour which includes highways/express ways/multi-level flyovers and ample car parking which will encourage more people to buy cars.

- Robust connectivity is another requirement which needs to be addressed on priority. As we see today more vehicles are equipped with GPS based connectivity which helps in vehicle tracking, fleet management, emergency assist, fuel conservation etc but lack of connectivity which is comparable to the developed nations can hinder the growth of telematics in India. Due to this, advanced features like car-to-car communication, car-to-infrastructure communication and cloud based navigation etc could take a backseat.

We feel that it’s the joint responsibility of network service providers, telematics system manufacturers/ OEM’s and the government machinery to streamline the telematics ecosystem in the country. The challenge for the industry is to therefore bring in more innovative products / features to the market with a competitive price tag.

Indian consumers are well aware about the features available in developed nations and their expectations are quite high. The real challenge is to provide the same service at a lesser cost. Eg. the software that gets developed should be configurable and scalable as it should support multiple languages.

Tata Elxsi Support

Connected car is one big area that has been swept by the revolutionizing concept called Internet of Things (IoT). Tata Elxsi‘s embedded product engineering business cuts across the key segments like Automotive, Telecom and Consumer Electronics where the adoption of M2M / Internet of things promises to make a big difference to the automotive world.

The widespread adoption of hand held devices like Smartphone and tablets have been influencing the automotive industry to change the customer driving experience. Presently, the user can enter a car and pair his / her smart phone to the Head unit and do a whole set of functions like call, navigation, playing audio/video etc. Soon the expensive infotainment head units could get replaced with smart phones with numerous applications like cloud based navigation, fuel reminders, driver profile, locating parked vehicles, real-time traffic scenario, battery state of charge, emergency/service assist, remote vehicle interaction etc. which will be more groundbreaking.

Tata Elxsi is already into the development of vehicle based and smart phone based applications which help OEM’s and Tier-1’s change the driving experience for the consumer. We are also involved in integration of connectivity features like Wi-Fi, DLNA and MirrorLink which enables user to have access to content on the move.

Having said this, tomorrow’s vehicle electrical architecture will become more complex as the car gets connected to multiple networks and ECU’s with different technologies running on the background. A user entering the car and connecting his personal device to the head unit would compromise the vehicle security. Similarly the improved connectivity enables the car to access information continuously from the cloud which again becomes vulnerable to potential hacking by unauthorized users tampering the ECU data thereby taking control of the vehicle.

Tomorrow’s vehicles should provide connectivity to the consumer devices but it should be safe, authentic and secure. Tata Elxsi is working on building security platforms like secured gateway modules which shall act as a central point for the wired and wireless networks and prevents unauthorized usage.

S.Vishwanath, Director, Automotive, TE Connectivity India

With India becoming one of the fastest-growing markets in the world for automobiles, this robust growth in the automobile industry has benefited the semiconductor & components market. Today, India is the world’s second-largest two wheeler manufacturer and one of the top ten car manufacturers. The main market drivers for the auto sector include a favourable demographic distribution with the rising working class and the increasing urbanization. The other important factors are the availability of a great variety of vehicle model with more preferences and easier finance schemes. The Automotive Industry has shown a commendable multiplier effect driving economy and employment. Being one of the largest industries in India, this industry has been witnessing impressive growth during the last two decades and has been able to constantly innovate, absorb newer technology, align itself to global developments and realize its potential.

Some of the key consumer demands which are driving more electronics in the car are:

More connected vehicles: more than 60 percent of the world’s cars will be “connected” by 2017- Remote real-time vehicle diagnostics, location based services, Wi-Fi technology, streaming media, functional integration, this will soon become a reality in India also and lot of it is already featuring in some of the high-end cars in India.

Safer Vehicles: Increase in regulations and safety norms. Consumers are getting more aware and therefore demanding, which is pushing OEMs to provide advanced capabilities like: innovative driver assistance systems: Lane departure and blind spot warnings, adaptive cruise control, automatic braking, telematics control systems, Warning and alert systems, cross traffic alerts, pedestrian protection, and inflatable seatbelts

Greener Vehicles: There is also a lot of research going on in terms of new materials, nano technology, biodegradable materials, and Hybrid and Electric Vehicles

TE Connectivity Focus

The first priority for us is to provide solutions that are needed here for specific Indian needs. We see that the design philosophies in Asia, US and Europe differ to a great extent as far as interconnections are concerned. We believe that even in India with its own OEMs and specific needs a different design philosophy will evolve which is highly value sensitive. We entered India almost 20 years back and have set up engineering and manufacturing bases in order to be ready for partnering with our customers in this pursuit.

As the regulations become more demanding be it emissions, safety or consumers becoming more demanding with infotainment, features the electronics on a vehicle increases significantly. All this electronics and the microcomputers that govern variety of functions on the vehicle are needed to be connected reliably. TE provides solutions to each and every need of interconnections on these applications. With India poised to be the 3rd largest automobile market in the world in the years to come, this will be a growth driver for the company.

There are three primary elements of our business strategy: Safe, Green and Connected.

– Safe – Whether it’s government mandate or consumer preference, the drive and desire for additional safety – Airbags, vehicle stability control, anti-lock brakes, lane-changing control, and autonomous cruise control, etc. TE is at the forefront of interconnecting all these. Since these are safety critical applications, the designs of our connectors have to be highly robust and reliable.

– Green – Green means reduced vehicle emissions and increased efficiency by reducing the weight of vehicles. We’re taking a three-pronged approach to helping our customer: We’re designing smaller components and cable assemblies. We’re innovating technology that enables usage of lighter and cheaper materials. We stay strictly committed to non-usage of heavy metals.

– Connected – Infotainment – More than ever, consumers want to integrate their devices with their vehicles. Our technology is enabling consumer connectivity and we are focused heavily on growing that business. A related development in the automotive industry is the emergence of the In-vehicle communication and entertainment systems. This is a relatively new opportunity in the Indian market and could potentially lead to significant growth in the electronic component sector.

Technologies at a Glance

- Miniaturization – We are setting the pace in miniaturization to keep consumers on the go, increasing connector reliability and durability in a smaller form factor, freeing up valuable space so manufacturers can add more functionality. Our Nano MQS family of connectors and terminals is a case in point.

- Harsh Connectivity – Electronics is finding its way into harsher, tougher environments. The vehicles are subjected to these hostile environments and are expected to work 24/7 without downtime. At TE, we have expanded our product range for harsh connectivity environments with the acquisition of Deutsch (73 year history of innovation and leader in connectivity for harsh environments)

- Fuel Efficiency – TE helps its customers innovate by taking weight out of the interconnections by using different enabling technologies such as miniaturized connectors, smaller wires or aluminium crimping etc. Over the next decade the need to save fuel and reduce weight will lead to greater adoption of multiplexed architectures and more control systems interconnected by Fiber instead of wire.

We are working on Technology that adds power not weight – For example, TE is solving hybrid & electric car challenges with- from 12V to 1000V:

o Reducing weight by safely replacing copper wires with aluminum

o Touch-safe solution for quick, easy high-voltage disconnection

o HV cable assemblies offer flexibility in design

The role of standards

Standards Organizations are certainly influencing the developments. Starting with the regulatory requirements and going down all the way to the some of the specifics on connectors & interconnection products – like Interface definitions, sizes of terminals / tabs etc… In order that the quality and reliability the entire supply chain is guaranteed, standards further influence the test and validation methods and processes that all the component, subassembly or functional units that are built by different Tiers of Automotive suppliers.

Having said this, there will be a slight differences on these standards by the regions – like, EU, Americas and Asia Pacific regions. We can also expect to see some OEM specific standards that could override some of the standards, based on their own preferences or experiences from their respective market.

Obstacles in the path

The dynamics of crude oil prices and domestic policies have adversely affected the demand of automobiles in the last two years. Not just the domestic demand, reduced exports since 2008 have also been a challenge for large-scale producers in India. Consequently, there is a widening supply-demand gap in automotive electronics.

TE Connectivity Support

Over the years we have worked at making our Indian operations more and more indigenized. This means not only utilizing the Indian work force by imparting them proper training, but also making products that are customized for Indian operations. As and how the global OEMs have entered India and the competition among auto companies has got tougher, the demand for high-quality connectors and terminals has shot up and we have kept pace with this changing demands. Currently 26% to 27 % of products that are sold are designed and manufactured in India. In the next 5 years TE is looking to make it 60%. The focus is to invest into the local market and develop products for the local market. TE India has more than 300 engineers working to produce local products for local consumption and customizing products for global customers. Out of which close to 50% are in Automotive. We design and manufacture products for largest OEMs across India like Tata Motors, Maruti, Ashok Leyland etc… This includes products like:

- Bulk head connections for electrical interface between and cabin and truck chassis.

- High current fuse boxes

- Products for Engine immobilizer

- Squib cable assembly for safety Air Bags

Mr. Sanjay Gupta , R&D Director – Automotive & Industrial MCU Group, India Design Center, Freescale Semiconductor

The automotive electronics market has shown tremendous potential in the last couple of years and is here to grow, while the industry is currently facing a downturn but as per industry expert this is a short term phenomena. According to a study conducted by the research group, IMS Research the market for semi-conductors in under the hood and body electronics will leapfrog from the existing Rs 48,099.12 crore to Rs 78,452.93 crore in 2017 and the main reason is attributed to the increasing use of semi-conductors in the new cutting edge systems.

So our focus clearly is to tap the automotive market space and create solutions which enhance a customer’s experience while driving a car. We have a wide range of products/solutions to cater to the automotive market and we are constantly innovating and upgrading our portfolio. We have developed solutions which will help the auto industry in providing the desired experience to the end user. We have various applications ranging from Advanced Driver Assistance Systems (ADAS) to Powertrain and Hybrid Systems. These applications can run in a modern day car and are meant to do specific jobs.

Technologies at a Glance

The auto industry is coming up with many new technologies where IoT is adding value. Few examples being: Biker fall detection where IoT can add layers of assistance if the unthinkable happens. BTLE on a motorcycle with a gyro and accelerometer sensing combination can detect a potential accident. Then, with a connection to the driver’s smart phone, the phone can send an alert to emergency services using the cellular network indicating that there is a potential accident. Similarly, Smart parking lot of future will let the cellphone user find and reserve a free spot without visiting each one. Sensors or cameras will alert drivers with the proper app on their smart phones where they can find an open parking spot.

The industry is constantly evolving with new technology innovations. In India, we are working with Tier 1 OEMs and many auto companies to bring many of the future technology to reality.

Natarajan MM, VP, South Asia, Arrow Electronics

India is an emerging region with 3rd highest YoY growth at 3.89% in Asia, according to iSuppli Market research. India market will continue to be driven by technological enhancements and also regulations . Hence we may see enhancements on Engine controls and power train driving on one side, and on other hand certainly stricter regulations will drive Safety and environmental control features.

Arrow Focus

Our focus will be on Body Electronics, Auto infotainment , and Compress Natural Gas (CNG ).

Technologies at a Glance

Advanced Driver Assistance System (ADAS) , Hybrid Vehicles , Enhanced Safety features are evolving and would sure continue to drive silicon content in a Passenger Vehicle or a Two wheeler

The role of Standards

India looks to ARAI for the guidelines , so far all the specs defined by them on safety and Environmental regulations have been very much in line with the global requirements and we too continue to look up to them when it comes to India . However our designs and our Design partners are capable to meet the needs as it emerges as it happening in rest of the Asian countries where we are supporting Automotive business .

Obstacles in the path

The demand exists as long as the aspirational buys for passenger Cars and 2 Wheelers remain dominant on other hand Infrastructural needs will drive Commercial Vehicles . What has been a road block in last few years has been the finances. Higher interest rates have regulated the purchases , which seems a short term sentiments and hence to us overall market looks optimistic more than otherwise.

Arrow Support

• Arrow is leading the development of the semi-autonomous motorcar and the systems integration, as well as the engineering of specific systems for the car, an initiative known as the “SAM Project” to modify a 2014 Corvette Stingray to be driven by head and facial movements using advanced technology.

• On May 18, 2014, IndyCar driver and current Verizon IndyCar Series Team owner Sam Schmidt demonstrated the car’s technology by driving multiple laps on the Indianapolis Motor Speedway at nearly 100 miles per hour. The SAM Project is a collaborative venture between Arrow, Ball Aerospace & Technologies Corp., Schmidt Peterson Motor Sports and Falci Adaptive Motorsports, a nonprofit.

• The SAM Project demonstrates, particularly to disabled people, that anything is possible with the help of technology, while also influencing a new generation of mobility and safety technologies.

Mr. Ravindra B.S, Senior Project Manager, Mistral Solutions

The Indian Automotive market is undergoing changes due to consolidation/new product offerings from both local and internal players. Recently, we are seeing a spate of global launches and new vehicles from all segments happening within India. The Indian Automotive market is expanding and this is evident from the emergence of players like Audi, Fiat, Renault, and Rolls Royce.

Technology consolidation/new technological advancements, new/updated Regulation Requirements and customer preferences are the main drivers in the Automotive Sector.

Mistral Focus

As of today, Mistral is already working in collaboration with several Global players. We hope to utilize and apply our global expertise while working with the Indian Automotive players to bring out innovative indigenous products in the cost competitive Indian market

Technologies at a Glance

Driver Assistance, Enhanced Vehicle Intelligence and Advanced Infotainment are the three technologies undergoing transformation and which are driving the Automotive Market.

The role of Standards

Greatly. The work of the standards organization is helping to have standard features/offerings for the Vehicle/Engine Intelligence. There is still much to do in terms of standardization when we talk about Autonomous Vehicles

Obstacles in the path

The greatest barrier/challenges are the lack of open-source movement/community around the Automotive Sector. Every vendor is closed and does not provide details about their Technology roadmap. There are multiple consortiums formed in the automotive sector which confuses the end customer and also Service partners

Mistral in Action

It is difficult to focus on the work of all the consortiums like Connected Car Consortium [CCC], Automotive Consortium, GENIVI and TIZEN. We are planning to focus on only one consortium and use that for our Technology ramp-up and customer offerings in the In-Vehicle Infotainment (IVI), Advanced Driver Assistance Systems (ADAS) and Telematics fields.

Ravi Manik, Director, Corporate Business Development, Broadcom

Industry analysts predict 100 percent of new cars to be Internet-enabled by 2025, an industry revolution that will redefine the driving experience and create opportunities for explosive business growth around the globe. As a result, the Indian automotive industry is witnessing a phase of rapid transformation, driven by stable economic growth and infrastructure development. According to industry experts, global auto companies are closely watching the Indian market to leverage the region as a global sourcing hub.

India’s Tata Motors and Samsung recently announced their intention to integrate Samsung’s Drive Link app in 2015 models, providing features such as navigation, call answering, Internet access, and text-to-speech for messages and emails or even social media updates. In addition, Nokia recently launched a $100 million connected car fund to invest in startups in and around the automotive ecosystem and India is one of the countries where the company will be looking for opportunities.

As with consumer electronics, technology has transformed the automotive segment with the rising introduction of sophisticated features such as seamless connectivity with mobile devices, advanced driver safety and in-vehicle infotainment. These features are not just restricted to the luxury vehicles, but have trickled down to lower segments too, proving to be a new factor of product differentiation.

The industry is also working towards what is known as Vehicle to Anything – or V2X Communications. Vehicle to vehicle (V2V) communications will enable the dynamic wireless exchange of data between your car and other cars on the road. The vision for V2V is that eventually, every vehicle on the road will be able to communicate.

Broadcom Focus

Broadcom has a dedicated staff based in India and employs a large a team in Bangalore focused on a variety of end market segments. This India-based team also makes major contributions to our hardware, chip and software design for emerging region-specific solutions.

Technologies at a Glance

Wi-Fi is the essential component in a connected vehicle and analysts expect an eight-fold growth in Wi-Fi enabled applications by 2019. Smart phone applications that can help drivers track vehicle performance and diagnostics as well as check on location, mileage and even gas mileage will soon become standard. Gigabit Wi-Fi will also enable software upgrades and new features to be pushed directly to the vehicle.

Bluetooth Smart technology promises to play a vital role in enabling connectivity between the car and wearable tech. Applications that can transmit biometric information such as blood alcohol content, glucose level and even driver fatigue are under development. Beyond in car applications, Bluetooth Smart technology opens up the possibility for vehicle-to-vehicle, vehicle-to-infrastructure and vehicle-to-person communications, allowing networked vehicles to communicate everything from crash, speed and upcoming hazards, to traffic alerts.

Near Field Communication (NFC) is usually associated with mobile payments or contactless transactions. More recently it has found traction with the automotive industry, providing easier pairing between the car and mobile devices, such as a smartphone or tablet. Applications include enabling digital keys and syncing devices by simply tapping the smart mobile to the integrated sensor inside the vehicle.

Automotive Ethernet connectivity connects the dots. Automotive Ethernet has given way for high bandwidth in-car connectivity at affordable rates and with lower weight cabling than traditional methods. High-end features such as infotainment and advanced driver assistance system, surround-view parking, rear-view cameras and lane departure warning can be deployed in a much broader range of vehicles and not only restricted to the luxury class, with the help of the low-cost automotive Ethernet.

As the connected car evolves, so do concerns about network security. The call for affordable, high bandwidth secure in-car connectivity was answered by Ethernet, the widely deployed solution that has given the world high performance network reliability for decades. With automotive Ethernet as the vehicle’s network backbone, security features such as device/message authentication and message encryption can be integrated to protect the car from malicious attacks, installation of non-service-approved devices and eavesdropping.

The role of standards

Standardization is essential as a major enabler for new and innovative in-vehicle applications, allowing automotive manufacturers to meet customer expectations and keep the bottom line in check. Organizations such as the OPEN Alliance SIG, Open Automotive Alliance and additional efforts by the IEEE are working together to move a variety of in-vehicle connectivity technologies forward through ongoing collaboration and standardization.

Obstacles in path

And with car makers struggling to compete in an already crowded field, they will be compelled to offer these features as standard equipment. Car makers are now leveraging connectivity as a competitive advantage but delivering features once associated only with the luxury class represents both a challenge and an opportunity.

Broadcom Support

Broadcom’s automotive-qualified Ethernet (BroadR-Reach®) has all the right elements required to enable the next-generation connected car. BroadR-Reach allows multiple in-vehicle systems (such as infotainment, on-board diagnostics and automated driver assistance) to simultaneously access information over unshielded single twisted pair cable. By eliminating cumbersome, shielded cabling, automotive manufacturers can significantly reduce connectivity costs (up to 80%) and cabling weight (up to 30%).

In terms of wireless connectivity, Broadcom’s Bluetooth Smart and next-gen Wi-Fi solutions are also paving the way to the connected car. Broadcom’s wireless automotive chips allow drivers and passengers to easily sync and stream content from mobile devices to the car’s infotainment system and rear-seat displays. The innovative chips also enable high-speed connectivity beyond the vehicle, serving Internet and cloud content via LTE telematics or directly from a Hot Spot connection.

Broadcom views the automotive segment as the next frontier for connectivity and as a leading provider of wired and wireless connectivity, we are playing a significant role in enabling the next generation connected car.

Joseph Chan, General Manager, I’M Intelligent Memory Limited

The electronics in cars become more and more complex and “intelligent”. The electronic devices get information from lots of sensors in the car and software optimizes many parameters for the motor, suspension, breaks or multimedia and comfort functionalities. With modern driver assistance systems, the traffic is being analyzed by cameras and radar-sensors and even allow to intervene actively in the driving process.

All these electronics require processors and memory devices.

The memory components used are typically DRAMs. A 1 Gigabit DRAM-component consists of 1 billion memory-cells, each one of them is a pair of a transistor and a capacitor. The capacitor is the part which stores the data-bits (0 or a 1) by “low charge” or “high charge”.

These capacitors are extremely small and their charge is very little. They can hold their charge only for a few milliseconds and require a periodic refresh to keep their content. Today’s DRAMs have to be able to work with minimal power supply, but at the same time have to be able to perform 1.6 billion data-transfers per second at high temperatures, maybe unstable supply-voltages and disturbances from other electronics. And all this needs to work at all times for all the 1 billion cells. If just one of those cells ever has an error, the whole system could fail.

The company Intelligent Memory (short IM) is coming up with a new solution to improve the reliability of DRAM components by integrating ECC error correction right into the memory-devices. IM calls the product series “ECC DRAM”. The IM ECC DRAM error-correction is performed by the DRAM itself, completely transparent to the processor.

Engineering samples are available now. Mass production is planned from November this year

TI introduces ultra-low quiescent current, high-voltage LDOs for direct-to-battery automotive applications

Broadening its large portfolio of low drop-out regulators (LDOs), Texas Instruments (TI) (NASDAQ: TXN) today introduced 17 new AEC-Q100-qualified, high-voltage LDOs for automotive and industrial applications. The new ultra-low quiescent current LDOs, including the TPS7A16xx-Q1 with 60-V input, TPS7A66xx-Q1 and TPS7B67xx families, and the TPS7B4250-Q1 LDO, support many applications that connect directly to a car or truck battery, such as cluster, power steering and infotainment systems, door modules and lighting controls. For more information, to order samples or purchase evaluation modules for the new ultra-low quiescent current, high-voltage LDOs, visit www.ti.com/autoldo-pr.

TI’s state-of-the-art semiconductor products allow manufacturers and system suppliers to deliver world-class features to the automotive market. Our extensive automotive portfolio includes analog power management, interface and signal chain solutions, along with DLP® displays, ADAS and infotainment processors, Hercules™ TMS570 microcontrollers and wireless connectivity solutions. TI offers SafeTI™ devices designed to help facilitate OEMs’ compliance with the requirements of ISO 26262, as well as parts specifically designated as compliant with the AEC-Q100 and TS16949 standards, all with product documentation. Visit TI’s Automotive page or TI’s E2E™ Community Behind the Wheel Blog to learn more about our commitment to automotive innovation.