The advancement towards more complex power management chips for mobile applications adds some new and major Automated Test Equipment challenges.

Today in fast evolving technology, Smartphone and tablets continue to advance at a rapid pace. Even the latest mobile devices are now moving towards 64-bit application processors, multi-mode RF front-ends, higher-end cameras and flashy LCD screens. Some systems can boast fingerprint scanners and heart rate sensors.

But battery life is an obvious part of the system continues to lag behind the curve. In response, Companies like Apple, Samsung and others have recently pushed mobile devices that feature new and improved battery life. Still, power-hungry software applications and wireless data adding pressing issue sometime.

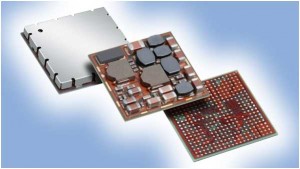

The One solution to mitigate such problem is to flow the power more efficiently. To achieve this efficiency, semicon manufacturers are proposing a new class of power management ICs, or PMICs, into the system. What is PMIC? They are analog/mixed-signal devices, which are designed to regulate and control the power in a system.

In many forms, the power management IC is becoming just as critical, and possibly as complex, as their digital counterparts like the application processor and baseband. “The PMIC is SoC (System-on-Chip) are getting more and more complex. The integration levels are getting higher. These power management devices, which were under 20 and 25 pins in the past, are now approaching 150 or 200 I/O pins.

As today’s mobile devices get more complex, OEMs are adding more power management ICs in the same device. The change toward more complex power management ICs for mobile devices adds some new and major ATE challenges. Today most suppliers of mobile chips, PMIC providers are under pressure to drive down the cost and hit the market window. This, in turn, requires ATE with more channels, higher levels of parallelism and other features.

How is PMIC test market growing?

PMIC market is called as one of the few high-volume segments in the fragmented analog chip business. According to Gartner and Dialog Semiconductor, tThe total available market for PMICs in smartphones alone is projected to grow from $1.5 billion in 2012 to $2.3 billion in 2015. The PMIC market for tablets is expected to grow from $400 million in 2012 to $600 million in 2015, according to the firms.

Dialog and Maxim are the two big PMIC players for mobile applications. Dialog dominates the PMIC business at Apple, but the chipmaker is gaining traction at Samsung. Maxim is strong at Samsung and is gaining ground at Apple. In addition, Qualcomm and others also sell PMICs.

Not long ago, PMICs were simple, discrete components. Now, PMICs are integrated, single-chip solutions that help reduce power, save board space and lower the cost in systems, Freedman said. “PMICs are an important part of the solution,” he said. “Dialog’s technology, for example, is playing an important role in enabling longer battery life within secular growth markets, including smartphones, tablets, and ultrabooks.”

In some cases, chipmakers are stacking PMICs with audio codecs in the same device. “Dialog’s solutions can be integrated along with multiple-power management and analog functions on the chip, such as programmable high-performance, low-dropout voltage regulators, intelligent battery charging circuits, USB interfaces, high-efficiency DC/DC voltage converters, sensor analog-to-digital converters and others,” Freedman said.

Basically, the PMIC consists of three main power IC components—boost regulators, buck regulators and low drop-out regulators (LDOs). An LDO regulator is a DC linear voltage regulator. Boost regulators are step-up regulators. Buck regulators, the power delivery workhorse in PMICs, are switched-mode power supply (SMPS) components.

Testing new and complex PMICs

The ability to test complex PMICs is easier said than done. For these devices, the tester must conduct as many as 2,000 tests for characterization, 500 tests for design verification and another 300 tests during production, according to Advantest.

On the other hand, the test methodology has not dramatically changed for PMICs, or analog/mixed-signal in general, over the years. As before, the tester must make multiple and simultaneous measurements on the various regulators in the chip.

In other words, testing new and complex PMICs requires a faster tester with more capabilities.Today’s mixed-signal tester for PMICs requires at least three types of pins. First, the tester requires high-speed digital pins to test the digital interfaces. Second, the tester needs to handle some audio functions. And finally, the tester requires voltage/current (VI) resources, which allows an engineer to precisely measure both current and voltage.

The next big thing in test for mobile PMICs is parallelism. For years, memory ATE has made use of parallelism to lower the cost of test. This involves the use of separate and high-speed systems called test handlers. With these handlers, the ATE can test multiple devices at the same time.

Technology at a Glance

Going forward, the PMICs themselves likely will see an increase in digital complexity. For example, the fuel gage and the charger control IC, which have been separate chips, may get integrated into the PMIC. Wireless charging is another possible candidate for integration.

This, in turn, will require vendors to upgrade the analog/mixed-signal tester. ATE vendors are also waiting for the long-awaited shift towards dynamic voltage scaling (DVS) for PMICs. Clearly, end-users want more battery life, prompting OEMs to develop new and innovative solutions. PMICs are just one part of the complex solution. All told, ATE vendors must stay ahead of the curve.