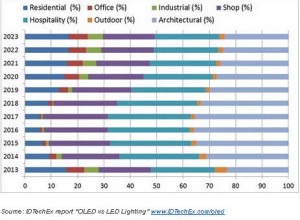

IDTechEx Research finds that in its “most likely” scenario, OLED lighting will become a $1.3 billion market in 2023, equating to just 1.3% of the market size

A report by IDTechEx “OLED vs. LED Lighting 2013-2023” says OLED lighting is likely to struggle to define and communicate its unique selling points and may remain an over-priced, under-performing option compared to LED lighting, unless Apple-like design innovation occurs.

A report by IDTechEx “OLED vs. LED Lighting 2013-2023” says OLED lighting is likely to struggle to define and communicate its unique selling points and may remain an over-priced, under-performing option compared to LED lighting, unless Apple-like design innovation occurs.

According to Dr. Norman Bardsley, Bardsley Consulting, and Dr. Khasha Ghaffarzadeh, head of consulting at IDTechExOLED, lighting companies will inevitably have to capitalize on superior design features to carve out niche markets in the hospitality, shopping and architectural sectors. Profits for panel makers will be squeezed due to stiff competition and value will migrate downstream to fixture/luminaire designers, who will be the demand creators.

Efficiency

OLED displays are growing quickly but their lighting counterparts are still actively trying to define their unique selling points vis-à-vis LED lighting. Today, they lag behind in terms of efficiency. This is because LEDs regularly offer 90-100 lm/W at package level (the LED chip encapsulated), while OLED modules are still in the region of 20-50lm/W. The lifetime of LEDs far exceed that of OLEDs. Indeed, LED lamps regularly offer in excess of 50,000 hours, which is why they initially found a niche market in out-of-reach outdoor applications. In contrast, OLED lighting offers 5,000 to 15,000 hours of operational life even when encapsulated.

Cost

LED lighting is also now low cost, selling at $5/klm at package level (luminaires costs $20-$100/klm). Contrast this with the extortionate price of OLED today. They cost $300-$500/klm at panel level, excluding the cost of fixture design, retail, installation and profit margins. The main cost drivers are the encapsulation layer (barrier, adhesive and desiccant) and integrated substrates (transparent conductive layer, substrate and out-coupling layer).

In the current configuration, cavity glass is used as the barrier. This is expensive because (a) additional processing is required (sand blasting) to carve out a cavity, and (b) large glass manufacturers are reluctant to commit production capacity given the low demand. A change in system configuration from, first, cavity to frit glass and, second, from frit glass to thin film encapsulation is needed to drive the cost down. Today, encapsulation layers (including desiccant and adhesive) cost $400-$500/m².

The integrated substrate is also a substantial cost driver. The integrated substrate includes the substrate (glass), transparent conductive layer (mostly ITO), metal electrodes, planarization (all patterned by photolithography/etch) and external light extraction film. The entire stack today costs $800-$900/m² although this can be driven down to $100-$120/m² in 2023. Innovation is taking place here with the advent of printing, grid materials, etc.

OLED lighting offers high potential for large-area emission, although today OLED production takes place on Gen-2 substrates only. Similarly, OLED lighting offers good form factors, although today most OLED lighting applications are made on rigid glass.

Nevertheless, OLED lighting is still embryonic

It is of course important to add that LED lighting development is far more mature – and more money has been spent on it than OLED lighting. Recently many companies have become active in OLED lighting and investment is increasing. For example, we expect the active materials to experience a fast cost reduction rate.

It is of course important to add that LED lighting development is far more mature – and more money has been spent on it than OLED lighting. Recently many companies have become active in OLED lighting and investment is increasing. For example, we expect the active materials to experience a fast cost reduction rate.

This is because of leverage from the OLED display industry and also because costs will scale with volume. This is different from the other two layers since the demand is mostly driven by factors outside the OLED lighting space. Currently, active materials cost $350-$400/m² but expect this to fall to $70-$90/m² in 2023.

The growth of the OLED display industry will aid the OLED lighting sector with cheaper, higher performance devices over time – with some overlap in supply chains. The challenges faced in OLED lighting applications will not be solved by the panel manufacturers alone.

Design Factors

LED lighting is intrinsically a point source light, whereas OLED lighting is a surface emission device. While OLED lighting is likely to have a competitive edge here, its advantage is not as compelling as first evident. This is because the use of multiple LEDs in conjunction with waveguides is enabling the effective realisation of surface emission. At the same time, most OLED production today takes place on Gen-2 substrates.

Form factor (mechanical flexibility) is often claimed as a major selling point too. Today OLED technology falls short due to the encapsulation layers being based on glass – but progress on flexible barriers for OLED displays is likely to help this in the future. OLEDs also have the edge on colour warmth, low weight and thinness.

The onus over the coming years is therefore likely to be on luminaire/fixture designers who develop and sell niche products, capitalising on improved design parameters made available by OLEDs.