- Q3 FY 2020: Revenue of €2,174 million; Segment Result €220 million; Segment Result Margin 10.1 percent

- Cypress consolidated since closing of acquisition on 16 April 2020. Preliminary purchase price allocation gives rise to goodwill of about €5.5 billion

- Outlook for Q4 FY 2020: Based on an assumed exchange rate of US$ 1.15 to the euro, revenue of between €2.3 billion and €2.6 billion is expected. At the midpoint of the guided revenue range, a Segment Result Margin of about 14 percent is predicted.

- Outlook for FY 2020: Assuming revenue in Q4 finishes at the midpoint of the guided range, revenue for the full fiscal year 2020 will be around €8.5 billion. At this level, the Segment Result Margin is expected to come in at about 13 percent.

Neubiberg, Germany, 4 August 2020 – Infineon Technologies AG is today reporting results for the third quarter of the 2020 fiscal year (period ended 30 June 2020).

“Infineon has so far coped well with the challenging situation caused by the coronavirus pandemic. As a company, we reacted quickly to the new situation and established a framework that has enabled us to stabilize our business. Our diversified business model – which is further strengthened with the integration of Cypress – has proven to be robust, especially in terms of profitability,” said Dr.

Reinhard Ploss, CEO of Infineon. “The pandemic continues to have a significant impact on our target markets, resulting in weaker demand in many product areas. Thankfully, we are seeing concrete signs of recovery within the automotive sector, which has been particularly hard hit. Infineon is also benefitting from increased digitization through the growing volume of data traffic, the Internet of Things and mobile communication. Our outlook for the final quarter of the fiscal year is cautiously optimistic. That said, our business performance is highly dependent on how the coronavirus pandemic continues to unfold worldwide, on the impact of the economic stimulus packages that have been implemented, and on a variety of geopolitical factors.”

Group performance in third quarter of 2020 fiscal year

Group performance in third quarter of 2020 fiscal year

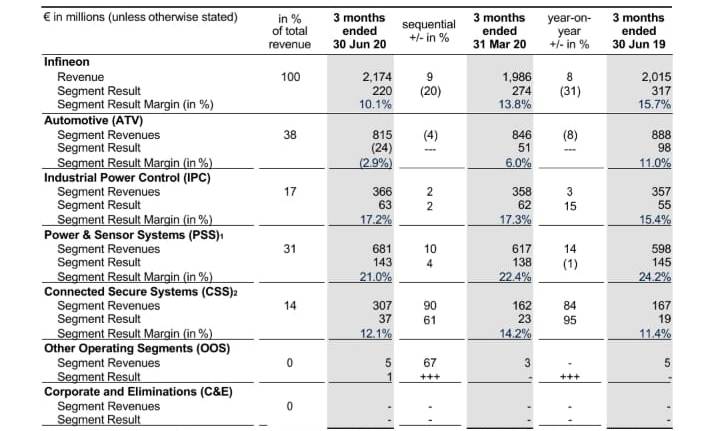

Revenue for the three-month period increased from €1,986 million to €2,174 million quarter-on-quarter. The acquisition of Cypress Semiconductor Corporation was successfully completed on 16 April 2020. Cypress has therefore been fully consolidated with effect from that date. Cypress’ various lines of business have been allocated to the Automotive (ATV), Power & Sensor Systems (PSS) and Connected Secure Systems (CSS)1 segments. The ATV and CSS segments have been allocated the largest share of revenue, while a smaller share was allocated to the PSS segment. The 9 percent growth in Group revenue was mainly attributable to the CSS and PSS segments. While IPC segment revenue remained stable, ATV segment revenue decreased, despite the first-time consolidation of Cypress.

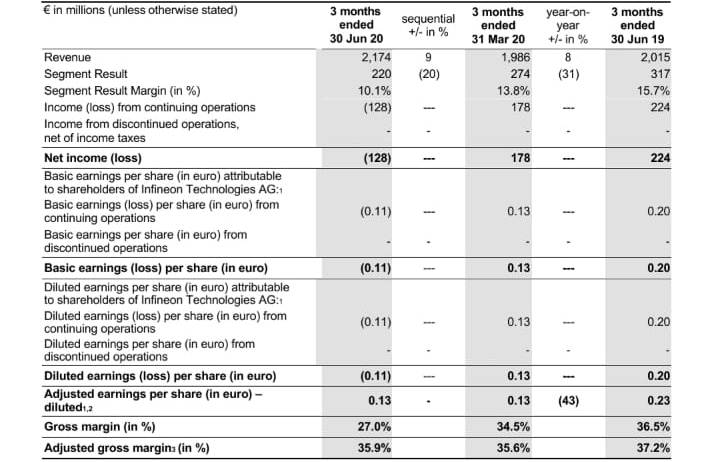

The gross margin for the third quarter came in at 27.0 percent, compared to 34.5 percent in the previous quarter, whereas the adjusted gross margin improved from 35.6 percent to 35.9 percent. The Segment Result declined to €220 million, compared to €274 million for the preceding three-month period. The Segment Result Margin fell from 13.8 percent to 10.1 percent.

The non-segment result for the three-month period was a net loss of €313 million, compared to a net loss of €48 million in the previous quarter. The significant increase was attributable to amounts recorded in conjunction with the acquisition and first-time consolidation of Cypress mainly related to the purchase price allocation. The non-segment result for the third quarter included €193 million of cost of goods sold, €79 million of selling, general and administrative expenses and €8 million of research and development expenses. In addition, net operating expenses amounting to €33 million were recorded.

In the third quarter, Infineon recorded an operating loss of €93 million, compared to an operating income of €226 million in the preceding quarter.

The financial result for the three-month period deteriorated from negative €27 million to negative €79 million quarter-on-quarter. The noticeable change was attributable partly to expenses connected with the financing of the Cypress acquisition and partly with the first-time consolidation of financial debt previously existing at Cypress. In addition the financial result includes an expense of €15 million arising on interest rate hedges entered into in conjunction with the refinancing of the Cypress acquisition.

The purchase price allocation undertaken in connection with the first-time consolidation of Cypress and the related release of deferred tax liabilities, gave rise to tax income of €44 million in the third quarter of the current fiscal year. In the second quarter the tax expense amounted to €21 million.

Income/loss from continuing operations deteriorated from an income of

€178 million in the second quarter to a loss of €128 million in the third quarter. As in the preceding three-month period, income from discontinued operations was zero. The third quarter of the current fiscal year therefore finished with a net loss of €128 million, compared to net income of €178 million one quarter earlier.

For the third quarter of the current fiscal year, Infineon reports negative earnings per share from continuing operations of €0.11 (basic and diluted), compared to positive earnings per share of €0.13 in the previous quarter. Third-quarter adjusted earnings per share2 (diluted) amounted to positive €0.13, unchanged from the previous quarter.

Investments – which Infineon defines as the sum of purchases of property, plant and equipment, purchases of intangible assets and capitalized development costs

– totaled €266 million in the third quarter of the current fiscal year, compared with

€247 million in the preceding three-month period. Depreciation and amortization went up from €249 million to €381 million quarter-on-quarter. The increase was mainly attributable to the first-time inclusion of depreciation and amortization relating to Cypress, comprising €52 million on newly recognized assets measured at their fair value or on assets remeasured at their fair value in conjunction with the purchase price allocation and €78 million of ongoing depreciation and amortization.

Free cash flow3 from continuing operations decreased to a negative amount of €7,137 million related to the purchase price payment for Cypress. Excluding cash outflows arising in connection with the Cypress acquisition and adjusted for cash acquired from Cypress, organic free cash flow would have been a positive amount of €439 million. In the preceding quarter, positive free cash flow amounted to €108 million, or €116 million excluding cash outflows arising in connection with the Cypress acquisition. Net cash provided by operating activities from continuing operations in the third quarter totaled €533 million, up from €354 million in the second quarter.

The gross cash position at the end of the third quarter of the 2020 fiscal year amounted to €3,450 million, compared to €4,588 million at 31 March 2020. The net cash position decreased from a positive amount of €3,051 million at the end of the previous quarter to a negative amount of €4,296 million at 30 June 2020, reflecting the impact of the Cypress acquisition and the related increase in gross debt to an amount of €7,746 million from €1,537 million in the previous quarter.

Cypress acquisition – refinancing

The acquisition of Cypress was completed on 16 April 2020. Based on a purchase price of about €8.3 billion determined in accordance with IFRS (net of cash acquired), the preliminary purchase price allocation results in goodwill of €5.5 billion.

For refinancing the purchase price, the Company’s share capital was increased by 55 million shares on 26 May 2020, thereby generating net proceeds of about €1.0 billion, which were used to repay part of the acquisition financing raised from banks for the takeover of Cypress. The share placement completed the equity portion of the refinancing of the Cypress acquisition.

Likewise for the purpose of refinancing the purchase price, fixed-interest notes totaling €2.9 billion were placed on 17 June 2020. The issuance comprises four tranches with various maturities and interest rates:

- €750 million with a term of 3 years and an annual coupon of 0.75 percent

- €750 million with a term of 6 years and an annual coupon of 1.125 percent

- €750 million with a term of 9 years and an annual coupon of 1.625 percent

- €650 million with a term of 12 years and an annual coupon of 2.00 percent

The proceeds from the share capital increase and from the issuance of notes were utilized to already fully repay the original bridge financing taken out to pay the purchase price for Cypress. Of the initial acquisition financing, three term loans remain in place totaling USD 3.3 billion.

Outlook for fourth quarter of 2020 fiscal year

Based on an assumed exchange rate of US$ 1.15 to the euro, Infineon expects to generate revenues of between €2.3 billion and €2.6 billion in the fourth quarter of the 2020 fiscal year, whereby the first-time consolidation of Cypress for a full quarter will contribute to the predicted quarter-on-quarter growth. In addition, revenue is expected to see a pronounced increase for the ATV segment and rise slightly for the PSS and CSS segments, while remaining flat for the IPC segment. The economic upheaval caused by geopolitical factors and the coronavirus pandemic makes reliable predictions more difficult. Key factors of the pandemic that will influence revenue performance are the progression of global infection rates over time and potential restrictions on economic activity as well as the level and effectiveness of government support programs.

At the midpoint of the guided revenue range, the Segment Result Margin is forecast to come in at about 14 percent.

Outlook for the 2020 fiscal year

Assuming that revenue for the fourth quarter corresponds to the midpoint of the guided range, full-year revenue for the fiscal year 2020 will amount to around €8.5 billion. At this level, the Segment Result Margin is expected to come in at about 13 percent.

Investments in property, plant and equipment, intangible assets and capitalized development costs in the region of €1.2 billion are planned for the 2020 fiscal year. Depreciation and amortization will amount to approximately €1.3 billion, including the effects of the preliminary purchase price allocation for Cypress.

In the current fiscal year to date, free cash flow has already been significantly impacted by the acquisition of Cypress as well as the economic consequences of the coronavirus pandemic and is expected to be significantly negative for the fiscal year as a whole. However, excluding cash used in connection with the acquisition of Cypress, organic free cash flow is expected to reach a positive value of more than €600 million.

Segment earnings in the third quarter of the 2020 fiscal year

ATV segment revenue decreased from €846 million to €815 million quarter-on- quarter, despite the first-time consolidation of Cypress. The former Cypress lines of business (mainly microcontrollers and specialty memories) accounted for almost one quarter of the segment’s revenue in the third quarter. The revenue drop compared to one quarter earlier was attributable to weaker demand across all fields of application caused by the coronavirus pandemic. Components for electric vehicles was the only area to record slight revenue growth quarter-on-quarter. The significantly lower level of revenue generated from operations caused the Segment Result to deteriorate to a third-quarter loss of €24 million. The equivalent figure for the previous three-month period was a profit of €51 million. The Segment Result Margin decreased from positive 6.0 percent in the second quarter to negative 2.9 percent in the third quarter.

ATV segment revenue decreased from €846 million to €815 million quarter-on- quarter, despite the first-time consolidation of Cypress. The former Cypress lines of business (mainly microcontrollers and specialty memories) accounted for almost one quarter of the segment’s revenue in the third quarter. The revenue drop compared to one quarter earlier was attributable to weaker demand across all fields of application caused by the coronavirus pandemic. Components for electric vehicles was the only area to record slight revenue growth quarter-on-quarter. The significantly lower level of revenue generated from operations caused the Segment Result to deteriorate to a third-quarter loss of €24 million. The equivalent figure for the previous three-month period was a profit of €51 million. The Segment Result Margin decreased from positive 6.0 percent in the second quarter to negative 2.9 percent in the third quarter.

IPC segment revenue edged up from €358 million to €366 million quarter-on- quarter, a 2 percent increase that mainly reflects higher demand for industrial drives and wind power turbines. Slight increases were also recorded for

photovoltaic solutions and home appliances, whereas revenue for traction-related products decreased, due to some projects shifted to the future. The third-quarter Segment Result amounted to €63 million, compared to the previous quarter’s €62 million. The Segment Result Margin slipped from 17.3 percent to 17.2 percent quarter-on-quarter.

In the third quarter of the fiscal year 2020, PSS segment revenue grew by10 percent to €681 million. The figure now includes the Cypress USB controller business, accounting for under 10 percent of quarterly segment revenue. In the previous three-month period, the segment generated revenue of €617 million. The AC-DC and the DC-DC power supply business areas recorded significant revenue growth on the back of continued brisk demand for products for servers and 5G cellular infrastructure. Business with products for mobile devices suffered as a result of the coronavirus pandemic, primarily due to weaker demand for smartphones. The Segment Result improved from €138 million to €143 million quarter-on-quarter. The Segment Result Margin came in at 21.0 percent, down from 22.4 percent in the preceding quarter.

Due to the first-time consolidation of Cypress’ industrial microcontroller and connectivity business, CSS segment revenue almost doubled in the third quarter of the current fiscal year to €307 million, compared to the previous quarter’s figure of €162 million. Against the backdrop of the coronavirus pandemic, demand was slightly weaker for numerous fields of application. By contrast, demand for contactless payment solutions increased. The Segment Result rose from €23 million to €37 million quarter-on-quarter. The Segment Result Margin for the third quarter came in at 12.1 percent, down from 14.2 percent in the previous three-month period.