-

Q1 FY 2015: Revenue of €1,128 million up 15 percent year-on-year; Segment Result of €169 million; Segment Result Margin of 15.0 percent; Segment Result Margin positively influenced by exchange rate and one-time effect of adjustment to rental payments for Group headquarters. Excluding these factors, Segment Result Margin at upper end of forecasted range

-

Outlook Q2 FY 2015 (excluding International Rectifier): Revenue increase compared with the previous quarter of between 5 and 9 percent and Segment Result Margin of between 12 and 13 percent expected

-

Outlook FY 2015 (excluding International Rectifier): Based on an assumed exchange rate of US$ 1.20 to the euro, revenue growth compared with the previous year of 12 percent, plus or minus 2 percentage points, and at the mid-point of that range Segment Result Margin of between 14 and 15 percent expected

-

Acquisition of International Rectifier successfully completed on January 13, 2015. Infineon is strengthening position as largest supplier of power semiconductors, offering the broadest portfolio of products and technologies for use in energy-efficiency applications

Neubiberg, Germany, January 29, 2015 – Infineon Technologies AG today reports its results for the first quarter of the 2015 fiscal year ended December 31, 2014.

“We had a good start into the new fiscal year. Revenue and margin have developed better than expected during the three-month period, in particular due to the strength of the dollar. Even adjusted for the tailwind from the dollar and one-time effects, reported figures would have been at the upper end of the forecasted range, reflecting Infineon’s ability to perform well, even in times of uncertainty. Compared in each case to the equivalent quarter of the previous year, our business has now grown for seven quarters in succession”, stated Dr. Reinhard Ploss, CEO of Infineon Technologies AG. “Market conditions remain challenging. We are nevertheless confident that Infineon will continue to grow. The successful acquisition of International Rectifier will provide an additional boost.”

Review of Group financials for the first quarter of the 2015 fiscal year

Review of Group financials for the first quarter of the 2015 fiscal year

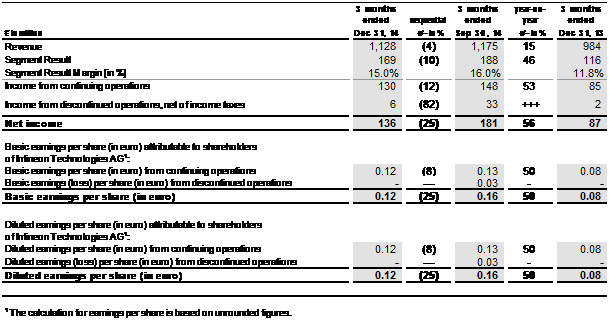

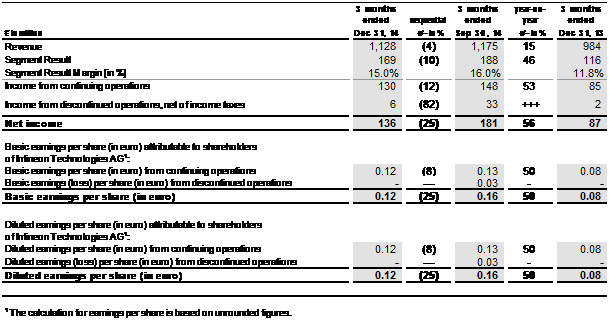

Revenue of the Infineon Group decreased by 4 percent quarter-on-quarter in the first quarter of the 2015 fiscal year to €1,128 million due to seasonality, compared with €1,175 million in the fourth quarter of the previous fiscal year. On a year-on-year basisit increased by 15 percent from €984 million in the first quarter of the 2014 fiscal year.

The lower-than-expected sequentially decrease in revenue partly reflected the fact that the US dollar was stronger than expected against the euro during the reporting period, adding some €20 million to Infineon’s revenue compared to the the assumptions underlying our previous guidance. Excluding this effect, the quarter-on-quarter decrease in revenue would have been at the more favorable end of the originally forecasted range of between minus 5 and minus 9 percent.

Segment Result fell quarter-on-quarter by 10 percent from €188 million to €169 million. The Segment Result Margin for the three-month period came in at 15.0 percent, compared to 16.0 percent in the fourth quarter of the 2014 fiscal year. As with revenue, the strength of the US dollar against the euro also impacted Segment Result positively. The reduction in the rental liability for the Group’s Campeon headquarters – recognized on a linear basis following a change in future expected rental payments – also had an additional positive one-time effect. Excluding these two factors, the Segment Result Margin would have amounted to approximately 13 percent and – similar to revenue – would therefore also have been at the upper end of the original forecast of a Segment Result Margin of between 10 and 13 percent.

Operating income for the first quarter of the current fiscal year totaled €153 million, compared with €118 million in the preceding quarter. The figure for the previous quarter included an exceptional expense of €83 million relating to a fine imposed by the European Commission in conjunction with antitrust proceedings against several manufacturers of semiconductors used in chip card applications.

Income from continuing operations decreased from €148 million in the preceding quarter to €130 million in the first quarter of the 2015 fiscal year. A tax expense of €24 million arose in the first quarter of the new fiscal year, corresponding to an effective tax rate of 16 percent. In comparison, Infineon reported a tax benefit of €29 million in the fourth quarter of the 2014 fiscal year, reflecting the fact that the current tax expense for that period was more than offset by the revaluation of deferred tax assets.

Income from discontinued operations decreased quarter-on-quarter to €6 million. The equivalent figure for the fourth quarter of the 2014 fiscal year was €33 million, reflecting the partial reversal of provisions in conjunction with the partial settlement reached with the Qimonda insolvency administrator.

Net income for the first quarter of the current fiscal year totaled €136 million, compared with €181 million in the preceding quarter. First-quarter earnings per share (basic and diluted) amounted to €0.12, compared with €0.16 one quarter earlier.

Investments – which Infineon defines as the sum of purchases of property, plant and equipment, purchases of intangible assets and capitalized development assets –amounted to €141 million in the first quarter of the 2015 fiscal year. This figure includes €21 million relating to patents acquired in conjunction with the settlement reached with the Qimonda insolvency administrator which are reported as “available for sale”. Investments in the fourth quarter of the preceding fiscal year totaled €242 million. Depreciation and amortization increased from €137 million in the preceding quarter to €141 million in the first quarter of the new fiscal year.

Free cash flow[1] from continuing operations in the fourth quarter of the 2014 fiscal year was a positive amount of €158 million. In the first quarter, the equivalent figure was a negative amount of €171 million, with a lower net income and changes in working capital contributing to the deterioration. More significant, however, was the impact of the payments made during the period relating to a fine arising in conjunction with EU-antitrust proceedings against the Chip Card & Security segment (€83 million) and to the purchase of Qimonda patents and the settlement of disputes relating to patent usage rights following an extra-judicial agreement reached with the Qimonda insolvency administrator (€125 million). Excluding these two exceptional cash outflows, free cash flow from continuing operations would have been a positive amount of €37 million. The payment of a further €135 million for the portion of the settlement reached with the insolvency administrator that does not relate to the Qimonda patents contributed to a negative free cash flow of €140 million from discontinued operations.

As a result of the negative free cash flow, Infineon’s gross cash position fell from €2,418 million at September 30, 2014 to €2,107 million at December 31, 2014. Correspondingly, the net cash position decreased from €2,232 million at September 30, 2014 to €1,917 million at the end of the first quarter.

Acquisition of International Rectifier

Infineon successfully completed the acquisition of International Rectifier on January 13, 2015. Due to the short period of time between the completion of the acquisition and the date of reporting the figures for the first quarter, Infineon has not yet reported on the acquisition in accordance with IFRS requirements and has not yet presented an outlook for the International Rectifier sub-group. Infineon is planning to report financials and an outlook for the entire Group (including the business acquired from International Rectifier) when reporting the figures for the six-month period on May 5, 2015.

For the quarter ended December 31, 2014, International Rectifier achieved revenue of US$275 million and an adjusted operating income-margin[2] of 7.0 percent in accordance with US GAAP (unaudited figures). Net cash stood at US$658 million as of December 31, 2014.

Outlook for the second quarter of the 2015 fiscal year (excluding International Rectifier)

Based on an assumed exchange rate of US$1.20 to the euro, Infineon expects quarter-on-quarter revenue growth of between 5 and 9 percent in the second quarter of the 2015 fiscal year. All segments are forecast to contribute to the expected revenue growth. A Segment Result Margin of between 12 and 13 percent is forecast.

Outlook for the 2015 fiscal year (excluding International Rectifier)

Based on an assumed exchange rate of US$1.20 (previously US$1.30) to the euro, Infineon forecasts a year-on-year growth in revenue of 12 percent, plus or minus 2 percentage points. So far, Infineon had expected sales growth of 8 percent, plus or minus 2 percentage points. At the mid-point of the planned range for revenue growth, the Segment Result Margin is expected to come in at between 14 and 15 percent. Previously, Infineon had predicted a Segment Result Margin of about 14 percent. The Power Management & Multimarket (PMM) and Chip Card & Security (CCS) segments are expected to record faster revenue growth than the average for the Group as a whole. The growth rate for the Automotive (ATV) segment should be roughly in line with the Group average. Revenue growth in the Industrial Power Control (IPC) segment is likely to be below the Group average.

Expected investments for the 2015 fiscal year are around €750 million containing an amount of about 13 to 14 percent of sales for investments for equipment within our operating facilities and for intangibles as one part. In addition between €60-70 million will be spent for readying the second shell in Kulim, Malaysia, for volume production and payments of €21 million are included for the purchase of Qimonda patents in conjunction with the settlement reached with the insolvency administrator of Qimonda AG. Depreciation and amortization is expected to amount to approximately €600 million.

Segment earnings in the first quarter of the 2015 fiscal year

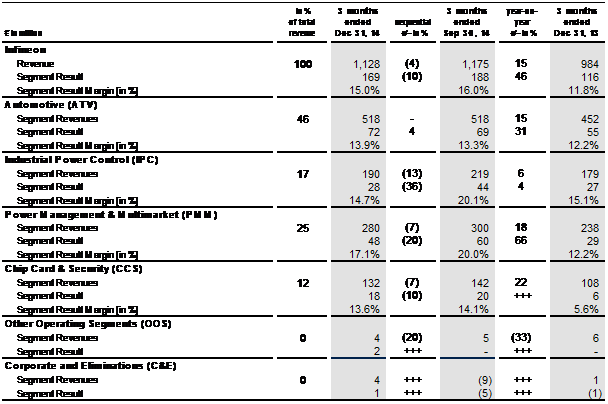

Unlike the normal seasonal pattern, ATV segment revenue did not fall in the first quarter of the 2015 fiscal year but remained unchanged at the previous quarter’s level of €518 million. Worldwide demand for vehicles continued to grow and was particularly dynamic in the USA. Demand for vehicles of German premium manufacturers also remained strong. Segment Result increased from €69 million in the fourth quarter of the 2014 fiscal year to €72 million in the first quarter of the new fiscal year. The Segment Result Margin improved to 13.9 percent, compared with 13.3 percent in the previous quarter.

Unlike the normal seasonal pattern, ATV segment revenue did not fall in the first quarter of the 2015 fiscal year but remained unchanged at the previous quarter’s level of €518 million. Worldwide demand for vehicles continued to grow and was particularly dynamic in the USA. Demand for vehicles of German premium manufacturers also remained strong. Segment Result increased from €69 million in the fourth quarter of the 2014 fiscal year to €72 million in the first quarter of the new fiscal year. The Segment Result Margin improved to 13.9 percent, compared with 13.3 percent in the previous quarter.

The IPC segment recorded revenue totaling €190 million in the first quarter of the new fiscal year, 13 percent down on the €219 million recorded in the fourth quarter, reflecting mainly lower seasonal demand for products used in electrical industrial drives, traction, renewables and major home appliances. Due to the drop in revenue, Segment Result fell quarter-on-quarter from €44 million to €28 million. The Segment Result Margin amounted to 14.7 percent compared with 20.1 percent in the fourth quarter of the 2014 fiscal year.

PMM segment revenue decreased by 7 percent from €300 million in the fourth quarter of the 2014 fiscal year to €280 million in the first quarter of the 2015 fiscal year. Whereas the power business followed the usual seasonal trend, revenue from products for mobile devices was only slightly lower. Demand for products for cellular network infrastructure applications even recorded a further increase. Segment Result went down quarter-on-quarter from €60 million to €48 million, with the Segment Result Margin decreasing to 17.1 percent from the preceding quarter’s 20.0 percent.

CCS segment revenue amounted to €132 million, 7 percent lower than the €142 million reported for the fourth quarter of the 2014 fiscal year. With 22 percent year on year growth the CCS segment significantly outperformed the Group average. Whereas demand for chips used in payment, mobile communication, authentication and pay TV applications decreased due to normal seasonal factors, revenue generated with products in government ID increased significantly, contrary to a usual seasonal decline. Segment Result decreased slightly to €18 million, compared to €20 million in the preceding quarter.The Segment Result Margin for the three-month period was 13.6 percent, compared to 14.1percent in the fourth quarter.

Analyst and press telephone conference

Infineon will host a telephone conference call for analysts and investors (in English only) on January 29, 2015 at 9:30 am (CET), 3:30 am (EST). During the call, the Infineon Management Board will present the Company’s results from the first quarter of the 2015 fiscal year. In addition, the Management Board will host a live telephone conference with the media at 11:00 am (CET), 5:00 am (EST). It can be followed over the Internet in both English and German. Both conferences will also be available live and for download on Infineon’s website at www.infineon.com/investor.

The Q1 Investor Presentation is available (in English only) at:http://www.infineon.com/cms/en/corporate/investor/reporting/index.html

Infineon Financial Calendar (*preliminary)

- Feb 12, 2015 Annual General Meeting 2015, Munich

- May 5, 2015* Earnings Release for the Second Quarter of the 2015 Fiscal Year

- Jun 2, 2015 DZ Bank Sustainability Conference, Zurich

- Jul 30, 2015* Earnings Release for the Third Quarter of the 2015 Fiscal Year

- Sep 22, 2015 Baader Investment Conference, Munich

- Sep 23, 2015 Berenberg Bank and Goldman Sachs German Corporate Conference, Munich

- Nov 11-13, 2015 Morgan Stanley TMT Conference, Barcelona

- Nov 26, 2015* Earnings Release for the Fourth Quarter and Full 2015 Fiscal Year

- Nov 30-Dec 3, 2015 Credit Suisse TMT Conference, Scottsdale/Arizona

[1] For definitions and the calculation of free cash flow and of the gross and net cash position, please see page 12.

[2]Operating income was adjusted by: amortization on intangible assets, restructuring, merger-related costs.