India is embarking on one of the worlds largest and most sustained procurement cycles. India has introduced Defense Offsets and due to it being one of the top military spenders in the world, the offset obligation is a significant opportunity that will need to be addressed by the expansion of private defense manufacturing.

The Defense sector has huge potential in India with the country ranked as the 10th largest investor in Defense globally. The industry is currently undergoing a transition with increased participation from the private sector. Private sector participation has been growing immensely in India’s indigenous Defense production as the sector transitions from being a supplier of raw materials and parts to one undertaking full scale licensed production.

The Defense sector has huge potential in India with the country ranked as the 10th largest investor in Defense globally. The industry is currently undergoing a transition with increased participation from the private sector. Private sector participation has been growing immensely in India’s indigenous Defense production as the sector transitions from being a supplier of raw materials and parts to one undertaking full scale licensed production.

The ambition to develop an indigenous Indian defence industry has been given increased prominence in the recent past and highlighted in policy statements both from government and opposition parties. It has been emphasized that both the Indian public and private sectors should play a larger role in producing state-of-the-art equipment for the Indian forces.

The challenge in India is to build domestic capability, which would be fully based on cutting edge technology. The process requires Indian public and private sector defence companies to leapfrog technologies and start designing, developing and producing state-of-the-art systems in the immediate future and not through protracted development programs. The only way to do so in a rapid way is to make use of technology developed by companies outside India.

Currently, defence procurement has tried to tackle this challenge mainly through strong offset requirements. However, while offsets do meet the requirement of a return on expenditure for a country, it has not proven to be adequate for developing an industrial base in the purchasing country. It rarely accomplishes a true transfer of technology to the Indian company. Foreign companies often leave once offset requirements are met.

The end result of the Government’s efforts should be the creation of a foundation for an indigenous defence industry that will ensure that the country does not need to look externally for its future strategic defence requirements. In addition, such programs should have significant spillover of technology to non-defence sectors.

Prime Minister Narendra Modi’s Make In India campaign has infused new energy in French defence companies to start manufacturing units in the country. India is expected to invest $200 billion in the next decade to modernise its armed forces.

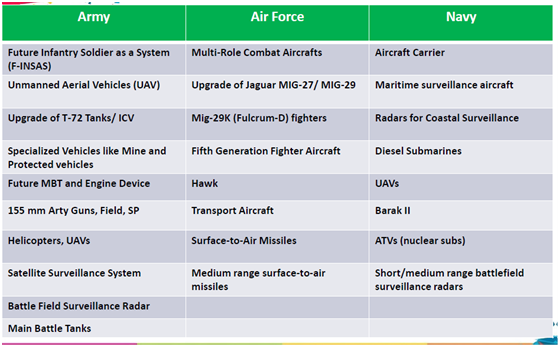

Indian Defence Forces Modern Equipments Required

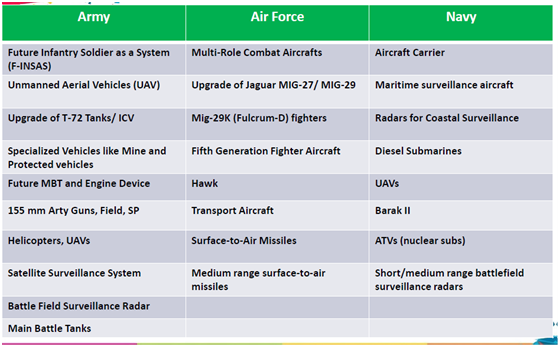

Indian Defence industry Technology Requirements

Indian Defence industry Technology Requirements

The Make-in-India initiative of the government is focussed on 25 sectors that include defence manufacturing. Is it a renewed invitation to foreign companies for, or a call to the Indian industry to shoulder greater responsibility in, making India a defence manufacturing hub? It could well be both but there is little doubt that the main focus of the initiative is on the foreign companies.

The makeinindia.gov.in website lists out the following reasons to invest in India in the defence manufacturing sector:

- India’s current requirements on defence are catered largely by imports. The opening of the strategic defence sector for private sector participation will help foreign original equipment manufacturers to enter into strategic partnerships with Indian companies and leverage the domestic markets and also aim at global business. Besides helping build domestic capabilities, this will bolster exports in the long term.

- Opportunities to avail defence offset obligations to the tune of approximately INR 250 Billion during the next 7-8 years.

- The offset policy (which stipulates the mandatory offset requirement of a minimum 30% for procurement of defence equipment in excess of INR 3 Billion) introduced in the capital purchase agreements with foreign defence players would ensure that an eco-system of suppliers is built domestically.

- The government policy of promoting self-reliance, indigenization, technology upgradation and achieving economies of scale and developing capabilities for exports in the defence sector.

- The country’s extensive modernization plans, an increased focus on homeland security and India’s growing attractiveness as a defence sourcing hub.

- High government allocation for defence expenditure.

These factors are important in their own right but are not new and if these alone could make it a manufacturing hub India would have been an industrial giant by now. An honest reality check would reveal chinks in this marketing strategy.

The strategic sector was opened to private participation more than a decade back. The offset policy was introduced in 2006. The revised guidelines introduced in 2012 have been under review for more than a year. The final decision on the May 2013 order that held ‘services’ as one of the permissible avenues for discharge of the offset obligation in abeyance is nowhere in sight. The ‘Make’ procedure was introduced in 2006 to promote indigenous research, design and development of high technology complex systems. Not a single Make project has taken off so far. The procedure itself is under review for more than a year. The allocation for defence, especially capital acquisition, is widely perceived as inadequate.

It would, therefore, be fair to ask what has changed that now makes it more attractive to invest in defence manufacturing in India. For sure, the change in government – widely seen as investor-friendly, decisive and keen to improve the eco-system – is an important factor. But investment decisions are made on more tangible considerations. Ease of doing business, security of investment and intellectual property rights, and returns on investment are more important than atmospherics.

The government seems determined to make it easier to do business in India but the task is daunting. Many steps, such as those related to acquisition of land, labour laws and taxation, require legislative action, cooperation of the states and a huge attitudinal change in the bureaucracy. More importantly, all necessary steps need to be taken concurrently. Disjointed efforts do not pay expected dividends.

Since it came to power in May 2014, the new government has taken three steps that have a bearing on defence manufacturing. A list of defence items requiring industrial license was notified in June 2014. A security manual for licensed defence industries was also notified the same month. In August, the FDI cap for the defence sector was increased to 49% with a provision that even higher FDI could be permitted if it provided access to state-of-the-art technology. These are welcome steps but not necessarily a game changer.

The current Make-in-India push of the government is an echo of MoD’s long-cherished aspiration for self-reliance in defence production. This was articulated in Defence Production Policy of January 2011. Paragraph 15 of the document says the Raksha Mantri will hold an annual review of the progress made during the year in self-reliance.5. No such review seems to have been carried out so far. For starters, this review should be initiated immediately involving the users and the industry, including the small and medium enterprises. Some questions that need to be looked at with reference to the promise made in the policy document are as follows:

- As the public version of the Long-term Integrated Perspective Plan, has the Technology Perspective and Capability Roadmap (TPCR) of April 2013 served its purpose which was to sensitise the industry about what the armed forces might need over the next 15 years so that it could prepare itself to meet the requirement? If not, why?

- Have the issues that impact the competiveness of the Indian defence industry in comparison with the foreign companies been identified and addressed?

- Why has the Make procedure intended to promote indigenous research, design and development not worked so far? What is holding up simplification of the procedure?

- Have necessary policies been put in place to encourage ordnance factories, defence public sector undertakings and the private sector to strengthen their research and development activities?

- What is holding up setting up of a separate fund to provide resources to public/private sector, including SMEs, as well as the academic and scientific institutions to encourage research? This assumes greater urgency in view of the announcement of a defence technology fund in the union budget speech by the finance minister.

- Are appropriate structures in place in MoD to synergise the efforts of all agencies and departments responsible for making India self-reliant in defence production?

While these are a few questions that arise in the context what the production policy of 2011 had promised, for any review to be meaningful it will have to cover many other related issues ranging from formulation of services qualitative requirements to procurement procedures.

India needs technology but it is unlikely to come through the offsets and FDI. If we have to buy technology, we must have the requisite procedure in place to evaluate technology. The procedure permits procurement based on inter-governmental agreements or strategic considerations but appropriate procedures do not seem to be in place to facilitate such procurement. All these uncertainties contribute to delay in decision-making.

Indian Defence Marketplace Key Players