Security and privacy concerns around cloud, however, act as inhibitor and continue to guide decision making for public cloud

IT service providers are preferred deployment partners but large pockets of opportunities also exist for public cloud providers, consulting majors and telecom network operators

Bangalore – September 5, 2014–According to a new study by market research and advisory firm Current Analysis, a significant 68 percent of enterprises in India, with 100-plus employees, are using Cloud-based services, while the remaining 32 percent plan to do so over the next 24 months. This is in line with trends in the larger Asia Pacific market where the adoption of Cloud-based services is as high as 65 percent. To give a perspective, in North America this number is 68 percent, says the study that spanned in 19 countries across four key regions globally.

“India is fast emerging as a high-growth market for Cloud services, led thus far by the private Cloud segment. However, there is huge potential for adoption of public Cloud services, which are in their early stages of market development and would need greater thrust from players such as IBM SoftLayer, Amazon Web Services, Microsoft Azure, Google, NTT Communications and Rackspace, to win enterprise trust and confidence for moving their workloads on the public Cloud,” said Harish Taori, Research Director for the Asia Pacific region at Current Analysis.

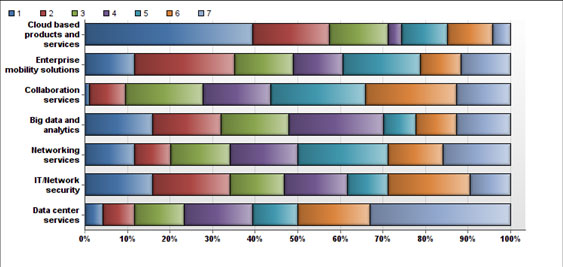

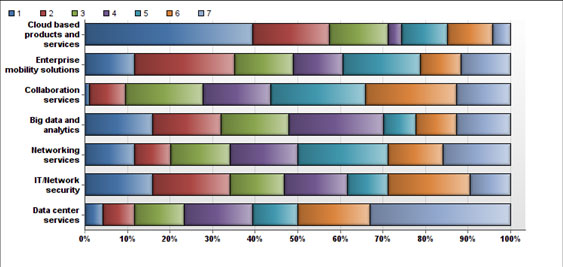

The study also finds that the scale of Cloud services adoption easily surpasses those of other new-generation ICT services including Big Data and Enterprise Mobility. While a significant 39 percent of the respondents ranked Cloud as their no. 1 investment priority in India, 16 percent said it would be Big Data while 12 percent favoured Enterprise Mobility. Network Security jointly ranked as the no. 2 investment priority, along with Big Data.

“It is highly notable that Cloud has emerged as a leading investment priority for Indian enterprises, surpassing even Network Security investments. However, this certainly doesn’t amount to the ICT decision makers lowering their guards when it comes to the all-vital area of IT security. It is just that they have gotten comfortable with the private clouds set up by their long-standing IT service partners like TCS, IBM, HP, Wipro and Tech Mahindra, among others,” said Deepak Kumar, Principal Analyst, APAC, Current Analysis.

That also explains why Indian enterprises favoured IT service players over public cloud players when it came to choosing partners for the deployment of Cloud, Big Data, Network Security, Enterprise Mobility and other such solutions.

Other key findings of the Enterprise ICT Investment Insights Study 2014include:

- For Infrastructure as a Service (IaaS), 38 percent respondents said they opted for a single cloud service provider while 35 percent said they are using two service providers and another 8 percent said they have three service providers. Around 12 percent enterprises have even gone for four or more suppliers.

- For Platform as a Service (PaaS), the enterprises that had opted for one, two, three and more service providers, stood at 35 percent, 37 percent, 8 percent and 4 percent, respectively.

- For Software as a Service (SaaS), the enterprises that had opted for one, two, three and more service providers, stood at 35 percent, 29 percent, 25 percent and 10 percent, respectively.

- Microsoft, IBM SoftLayer, HP, AWS, Google, Salesforce.com, Red Hat, Oracle and SAP were among the leading cloud service providers across the IaaS, PaaS and SaaS cloud market segments.

- When moving a workload to cloud, security (62 percent) continued to be the biggest concern for enterprises, followed by data privacy (42 percent).

- IT service providers were also preferred partners for Managed Network Services, Enterprise Mobility and Big Data and Analytics solutions. However, Consulting Companies like Accenture, Capgemini and Deloitte came close enough as preferred partners for implementing Enterprise Mobility solutions.

- Similarly, for Managed Secure Network-to-Cloud Solutions too, Consulting companies were a close No. 2 as preferred partners and Equipment Vendors like Cisco, Avaya and Oracle were not a distant No. 3 either.

- Data Center investments showed clear signs of falling behind on enterprises’ priority list, with a sizable 33 percent saying it was a last investment priority for them and a mere four percent said it was still a No. 1 investment priority. This finding alludes that enterprise priorities are moving from capex to opex model with cloud services being the highest investment priority for enterprises in India.