Demand for Intelligent, Safe & Comfortable Cars Drives the Automotive Sensors Market

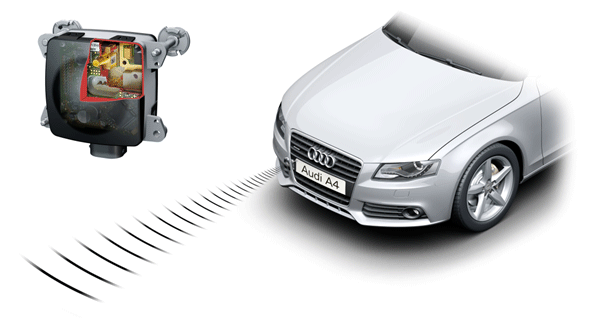

With the rapid growth of connected technologies, the ability for machines to send, receive, and process information is enabling automation at an unprecedented scale. One of the key markets that is intricately tied to this increase in computational ability is the global sensors market. The software boom has made machine accessible information vital to the digital economy. However, for automation to reach its full potential, it is not enough for machines to simply use information efficiently, they must also be able to gather information in new and innovative ways. Without an occupancy sensor, smart lighting controls wouldn’t be feasible. Without a smoke detector, automated sprinkler systems wouldn’t be able to function properly. Similarly, without cameras, and LIDAR and radar detectors, autonomous driving would not be possible.

With the rapid growth of connected technologies, the ability for machines to send, receive, and process information is enabling automation at an unprecedented scale. One of the key markets that is intricately tied to this increase in computational ability is the global sensors market. The software boom has made machine accessible information vital to the digital economy. However, for automation to reach its full potential, it is not enough for machines to simply use information efficiently, they must also be able to gather information in new and innovative ways. Without an occupancy sensor, smart lighting controls wouldn’t be feasible. Without a smoke detector, automated sprinkler systems wouldn’t be able to function properly. Similarly, without cameras, and LIDAR and radar detectors, autonomous driving would not be possible.

Sensor innovation is prime for growth not only in existing sensors, but also in the development of new sensors. Right now sensors can be used to monitor light, moisture, temperature, pressure, chemical properties, and torque among other things. However, there still remains tremendous opportunity in the development of sensors that enable machines to perceive in ways that they have never perceived before. If the camera enabled machines to see, is there a sensor that can enable machines to smell? One area of innovation for new sensors is true wireless sensors enabled by energy harvesting. Sensors are most effective when they can be installed without having to depend on external power or network wiring. Because they are generally low energy devices, energy harvesting is emerging as a viable method of powering sensors.

While sensors themselves are integral to the connected technology ecosystem, the major value add will come from sensors with integrated software systems that can translate sensor data into a language that other systems can understand and act upon. Sensors without software, or sensors with embedded software that is not easily accessible to existing systems will increase the cost of solution development. As sensors become increasingly integrated into a variety of systems, the development of standards for sensors will likely be a necessary development. This is particularly pertinent for sensors that can cut across applications and solution spaces, such as those being developed by AMF Nano.

Overall, the market for sensors is set for rapid growth, and development of new sensor technology is crucial to enabling increased automation.

India automotive sensors market

The India automotive sensors market is expected to grow to $1.51 billion by 2018 at a CAGR of 11.64% over the period 2015-2020. The Indian government’s move to make the installation of certain automotive sensors mandatory (especially for two wheelers), would drive the rapid growth of automotive sensors in all the vehicle segments of the Indian automotive market. In addition the growing demand for premium and luxury vehicles would help to augment the growth of the automotive sensor market significantly. The sales of passenger vehicles have also shown a rapid growth in India, with Y-to-Y sales growing up by 8.45% till October 2015.

The demand to automate every automotive component, which can sense, and act, would continuously ask for innovation in different types of automotive sensors. The OEMs operating in the Indian market, are looking to differentiate the vehicles with that of the competitor, by incorporating several new features based on sensors. Continental, one of the premier automotive sensor manufacturer had developed a comprehensive series of advanced automotive sensors to increase vehicle automation and improve various functional efficacies of the vehicle. One such advancement is the Intelligent Battery Sensor, which continuously analyses the status of conventional 12-Volt lead-acid batteries and provides information on key parameters such as the state-of-charge, state-of-function (power ability) and state-of-health (aging) of the battery. The battery sensor could be deployed to any standard battery system.

In addition, the government has formulated a scheme for faster adoption and manufacturing of Electric and Hybrid Vehicles in India, under the National Electric Mobility Mission 2020. This move by the government would encourage the progressive induction of reliable, affordable and efficient electric and hybrid vehicles in the country. Electric and Hybrid Vehicles have an extensive range of vehicle sensors in various applications of the vehicle ranging from powertrain and chassis, body electronics, safety and security etc. Thereby the growth of electric vehicles would significantly help to augment the growth of the market. However the heavy cost associated with these sensors would pose a threat in the adoption of these systems.

The India Automotive Sensors Market is segmented on the basis of Type (Temperature, Pressure, Speed, Level/Position, MEMS, Magnetic, Gas, and Inertial), Application (Powertrain, Body Electronics, Vehicle Security Systems, Alternative Fuel Vehicle, and Telematics). The Pressure and MEMS sectors are expected to be the major segments pioneering the growth of the market in the forecast period. In application, sensors used in the powertrain (especially in engine and chassis) would significantly grow to remain the largest contributor in the automotive sensor application market. However sensors used in the alternative fuel vehicle would grow with the highest rate, due to the growing adoption of electric and hybrid vehicles in the forecast period.

Mr. Sanjay Gupta, Vice President and India Country Manager, NXP India discusses automotive sensors market, key drivers and growth.

The automotive electronics industry has undergone a major transformation in past decade and is evolving rapidly. This evolution continues to happen with the onset of technologies like IoT and NFC etc. The demand for automotive electronics has also seen a surge as consumers are exploring smart, secure and connected options for driving. In India too, this segment has metamorphosed significantly.

We are seeing a trickle-down effect in this segment as now it is not just restricted to luxury vehicle but has started to act as a point of differentiation in the lower segment as well. According to Markets&Markets Research, the global market for automotive sensor is set to rise to reach USD 30.90 Billion by 2020, at a CAGR of 7.72% between 2015 and 2020. Reportlinker predicts the India automotive sensors market to grow to $1.51 billion by 2018 at a CAGR of 11.64% over the period 2015-2020.

Today 90% of auto innovation is happening via electronics and there is furthermore opportunity in this segment. The Indian government’s move to make the installation of certain automotive sensors mandatory, would drive the rapid growth of automotive sensors in all the vehicle segments of the Indian automotive market. In addition the growing demand for premium and luxury vehicles would help to augment the growth of the automotive sensor market significantly. The crux lies in the evolution of the semiconductor space as it is playing an instrumental role in making vehicles advanced and more user friendly. The space covers a very wide area from vehicle networking, automotive lighting, car infotainment to, any electronic circuit present in a car, involves different semiconductors working together. All these mechanisms generate one thing in common – Data. Majority of today’s automotive and industrial systems depend on an accurate and reliable supply of information. At NXP, we provide an extensive portfolio of high-performance sensor solutions to deliver exactly that.

Key trends and developments

Any modern car contains up to 100 control units (ECUs), managing everything from infotainment to mission-critical systems. Innovation especially in this segment is growing and will also be in trend for the next decade and will be instrumental in enhancing a connected yet secure driving experience. There is a massive drift towards product innovation. Today, manufacturers use innovations like smart objects, autonomous production, and access to the cloud to support customization on a large scale and product innovations in close to real-time. The use of NFC, IoT will further increase automation significantly. This paves way for complex electronic systems.

There has been a major thrust in the safety and infotainment/interior electronics space already, with safety being mandated by governments and ratified by a consortium of automotive OEMs in recent times. Consumers are moving towards technological developments which will make their life easy and hassle free. In the age of digital connectivity, the technology inside car plays an important role. The demand has also fueled developments in the lighting, emergency systems, and display space in the automotive interior and exterior electronics spaces.

NXP Automotive Sensors Solutions

NXP offers greater levels of intelligence for richer applications. It is no longer about what each sensor does, but how you unlock the potential of sensors with multiple sensor inputs, logic and other building blocks to bring greater value and decision making to the overall sensing solution. It’s more than a sensor translating a signal.NXP is a leading supplier of automotive semiconductors. Our two main sensor families cover silicon sensors for determining temperature and magnetoresistive (MR) sensors for angle, rotation and weak-field measurements. Both families offer precise measurement, reliable operation and long lifetimes. All our sensors have the ruggedness and reliability needed to meet the exacting automotive quality standards.

The exceptional accuracy, reliability and robustness of MR sensors make them ideal for automotive applications. Applications can employ a wide air gap between sensor and target. This is possible due to conditioning the MR sensor’s signal, where the offset, gain and hysteresis are digitally adapted to ensure an exceptional air gap capability.

We are also investing heavily in vision technology, which will help the car in feeding the vision information real time in an HD format. This information will simultaneously be processed and help the car to make decisions under every circumstances. Converting this visual information into digital form require intense hardware and software working at a high level of sophistication. We already have prototypes in the market where the customers are evaluating and giving us feedbacks because it is not easy to mimic human brain. We are global leaders in ADAS, a technology beyond radar and human vision. Currently, we have Accelerometers, Angular Sensors, Pressure Sensors, Rotational Sensors, Gyroscope, and Temperature Sensors etc. NXP is integrating more sensing types with compatible software creating sensing platforms. We have all the right technologies both in analog and digital world and are confident that these trends will fuel the future growth of the automotive market.