Cloud computing has been driving the need for larger and larger scale datacenters with higher and higher bandwidth network fabrics. As datacenter networks scale, optics is becoming ever more important from ultra-long-distance transmission between datacenters to short-reach interconnects inside datacenters.

Unrelenting demand for more communications bandwidth for data center networking is challenging interconnect technologies, such as Ethernet, Infiniband, Fibre Channel, and Serial-Attached SCSI (SAS).

Unrelenting demand for more communications bandwidth for data center networking is challenging interconnect technologies, such as Ethernet, Infiniband, Fibre Channel, and Serial-Attached SCSI (SAS).

Today, data centers need increasingly higher speeds, design flexibility and a cost-effective migration path. Bandwidth requirements continue to grow, driven by virtualization, “big data,” mobile applications, new ways of working, service and network convergence, and high-bit-rate video and audio streaming. The arrival of new technologies and platforms, such as ultra-high-definition 4K video will accelerate this trend further. For now, the introduction of more and more 10GBase-T equipment and the upcoming 40G standard are vital drivers. All these developments have far-reaching consequences for data center design and cabling.

One recurring question is whether copper handle the bandwidth requirements of today’s active data center equipment—and whether it also supports coming generations. After all, copper appears to have inherent distance limitations that may appear on the short side. Not too long ago, many people argued that only optical fiber would work for higher data rates.

Optical Interconnects for Future Data Center Networks

In Very Short Reaches (VSR) below 100m (data centers, board-to-board, inter-rack, chip-to-chip and intra-chip interconnection), signals can easily be routed from fiber into copper and from optical to electrical interconnection.

In Very Short Reaches (VSR) below 100m (data centers, board-to-board, inter-rack, chip-to-chip and intra-chip interconnection), signals can easily be routed from fiber into copper and from optical to electrical interconnection.

Due to easy installation and lower cost transceivers, copper provides a very cost effective solution. However, as previously noted, the demand for greater speed is expanding the use of the optical interconnection into such network domains.

The rise of cloud computing and web applications such as streaming video and social networks has created the need for more powerful data centers that can sustain much higher bandwidth than a few years ago. This trend requires high-performance interconnects for the data center networks that can sustain this bandwidth inside the data centers without consuming excessive energy.

In the last few years many researchers have pointed out the limitations of the current networks and have proposed as a viable solution data center networks based on optical interconnects. Data center networks based on optical interconnects are an interdisciplinary field which encompasses such fields as computer networks, computer architecture, hardware design, optical networks, and optical devices.

Photonics sheds Light

Moving Data with Silicon and Light Integration

![]() Currently data center designers essentially have two optical interconnect options: short reach (SR) and long reach (LR). The problem is that SR optics (or traditional VCSEL based optics) are limited in the distance they can transmit. That limit is generally accepted at 300 meters, and many product offerings can only go 100 meters and in some cases even down to 50. They offer a significant advantage over copper interconnects, but are now suffering the same problems copper interconnect had: as data transmission speeds increase, the distances that can be run are getting shorter and shorter. Yes, some of that impact can be mitigated by installing (yet another) fiber upgrade to OM4. However, network designers are getting weary of very expensive and difficult to implement structured cabling upgrades as speeds continue to increase. In short, SR optics have increasing limitations as distances and speeds increase.

Currently data center designers essentially have two optical interconnect options: short reach (SR) and long reach (LR). The problem is that SR optics (or traditional VCSEL based optics) are limited in the distance they can transmit. That limit is generally accepted at 300 meters, and many product offerings can only go 100 meters and in some cases even down to 50. They offer a significant advantage over copper interconnects, but are now suffering the same problems copper interconnect had: as data transmission speeds increase, the distances that can be run are getting shorter and shorter. Yes, some of that impact can be mitigated by installing (yet another) fiber upgrade to OM4. However, network designers are getting weary of very expensive and difficult to implement structured cabling upgrades as speeds continue to increase. In short, SR optics have increasing limitations as distances and speeds increase.

The other option to fill the distance gap has been long reach (LR) optics. They function very well, but because they are designed for very long distances (100KM and higher) they are both very costly and use lots of power. Cost and power consumption are the serious issues in data center design, so that solution is not really viable.

The market has been seeking a third option, single mode silicon photonics base active optics are uniquely positioned to satisfy this growing market requirement.

Recent Intel’s big announcement is that a number of component and cable makers — U.S. Conec, Corning, Tyco Electronics, and Molex — have lined up to sell MXC parts and cabling, pushing the technology closer to becoming a practical solution instead of merely a nifty idea.

MXC uses Intel’s Silicon Photonics technology, which, as the name implies, uses optical networking and silicon components to shuttle data between systems in a data center. The MXC standard works with a specially designed lensed connector to reduce connection problems, and it can support up to 64 fibers per cable. The cables can transmit a theoretical maximum of 800Gbps each way with a total of 1.6Tbps in both directions, are thinner than their copper counterparts, can run up to 300 meters without signal degradation, and can carry conventional Ethernet as well as PCI-Express 3.0 signals.

SiPh progress by chipmakers and semiconductor firms

Chipmakers Intel, IBM, NEC and Cisco regard silicon photonics as a promising technology that can change how datacentre systems exchange data and make rack equipment leaner, and they are investing in the technology.

Cisco is also betting on the technology. It acquired a SiPh startup, Lightwire, in 2012 to deliver high-speed networks with the “next generation of optical connectivity” that can enable datacentre users to meet the growing demands of video, data, voice, mobility and cloud services.

IBM, too, is investing in the technology. Its “silicon nanophotonics” uses light instead of electrical signals to transfer data, allowing large volumes of data to be moved rapidly between computer chips in servers, large datacentres and supercomputers via pulses of light.

In 2012, IBM announced it had constructed a 1Tbps parallel interconnect using external vertical-cavity surface-emitting lasers (VCSELs) and photo-detectors communicating through 48 holes drilled through a 90nm silicon complementary metal-oxide semiconductor (CMOS) chip.

Meanwhile, in Europe, STMicroelectronics signed an agreement with Luxtera to develop a dedicated silicon photonics process at its wafer laboratory in France.

Silicon photonics is also capable of feeding a number of parallel optical data streams into a single fibre, which will reduce datacentre cabling problems.

But although suppliers may be keen to commercialise silicon photonics, is the industry really ready for it?

Copper cabling is limited partly by distance restrictions, and the traditional optical approaches currently available have size, cost and power issues.

Silicon photonics devices far exceed the capabilities of copper cabling by offering data rates of about 100Gbps and so are better suited for HPC applications and datacentres.

Excitement has been created around products and devices based on SiPh, partly as the telecom and data communication segments are moving to 100Gps interconnects. But even if Intel starts to ship such connections by the end of this year, experts feel the penetration into datacentres will be relatively slow.

One reason for this could be that the existing on-board connectivity in datacentres is not “retro-fittable” and a datacentre would have to rip off its existing architecture to accommodate silicon photonics.

A Gartner research paper describes silicon photonics as a transformational technology offering many advantages, including large data rates, longer-distance connections, low latency and volume economics.

Preman Ninan, Senior Sales Manager, Molex India

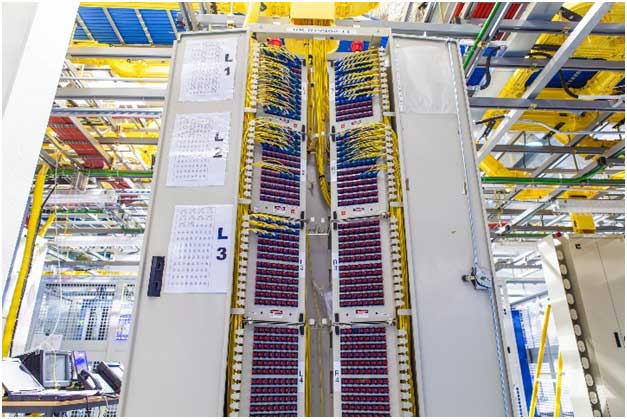

“Over the past 20 years, the global connector industry has grown at an annual rate exceeding 5%. The market outlook remains very positive, with the growth of cloud computing and “big data” driving a data-center buildout, worldwide, accompanied by increasing demand for high bandwidth connectivity. This will have a significant impact on the market for fiber-optic cabling and connectors, in particular. Market research firm Transparency Market Research is predicting that the market for fiber-optic cabling and components, which was worth US$1.9 billion in 2011, will be worth US$2.9 billion in 2017, for a CAGR of 9.5%.

Key market drivers will include the formation of the Internet of Things, the increasing reliance of the enterprise on data in “the cloud,” advances in automotive electronics, and at the consumer level the continued proliferation of ultra-mobile devices such as smartphones and tablets, augmented, possibly, by an accompanying wearable device such as a smartwatch.

A high-growth industrial sector is automotive electronics. Cars and vehicles are now being fitted with electronic sensors, safety systems, infotainment devices, cameras, navigational aids, in-vehicle networks, solid-state lighting and flat-panel displays. Vehicles are increasingly becoming multi-functional electronic environments, and this drives demand for an array of interconnect options.

Molex has responded by introducing a high speed data bus, the HSAutoLink, which incorporates a variety of interconnects, including USB, LVDS, IEEE 1394b (FireWire), FlexRay, eMOST and Ethernet.

A second hot high-growth market is the medical industry. A wide range of medical equipment and instrumentation now incorporates sophisticated electronics, including connectors. Using Laser Direct Structuring, medical device designers can integrate highly complex functions into highly compact solutions, using a 3-axis laser to image micro-line circuitry, which existing 2D technologies cannot accomplish. Lines and spaces down to 0.10 mm (0.004 inch) and a circuitry pitch down to 0.35 mm (0.014 inch) are now possible.

The overwhelming market demand is for increased data bandwidth, and the challenge is the development of fiber-optic interconnects. Here, Molex has developed the Circular Lensed MT Expanded Beam Interconnect Solution, able to meet the requirements of data intensive industries.

Molex has also developed the world’s first fully integrated 4x28Gbps optical engine, enabling 100 Gbps Ethernet and EDR InfiniBand interconnects, as well as embedded optical transceivers.

Another market challenge is the demand for ultra-mobile devices, such as smartphones, and this means miniaturization of the interconnect. Molex Slimstack™ high-speed micro-miniature board-to-board stacking connectors, with speeds up to 20 Gbps and pitch sizes ranging from 0.35 to 1.00 mm, provide a space-saving design flexibility that is ideal for a variety of wireless or portable applications.

The challenge of automotive electronics is the design of new generations of microcontrollers, SoCs and Flash memory devices. These chips must comply with stringent international standards, including ISO/TS16949 and AEC-Q100.”

Molex Solutions

What is not always understood is that Molex interconnect solutions are nearly always leading the industry in innovative cutting-edge solutions. A case in point is the compact zCD™ Interconnect System, capable of supporting next-generation applications in telecommunications, networking and enterprise computing environments. The Molex zCD interconnect is able to transmit data at a 400 Gbps data rate (25 Gbps over 16 lanes), with excellent signal integrity and electromagnetic interference protection.

Similarly, products for use in advanced medical applications are available from Polymicro Technologies, a Molex subsidiary and the world’s leading supplier of silica capillary tubing and specialty optical fibers, optical fiber and capillary assemblies, discrete micro components and quartz optical fiber ferrules.

Current R&D activities at Molex are directed toward high-speed signal integrity, miniaturization, higher power delivery, optical signal delivery and connectors for harsh environments – all factors that will enable us to deliver the next generation of cabling and interconnect solutions.